|

CANNA NEWS

STATE AND REGULATORY NEWS

House approves marijuana banking, employment and D.C. sales

provisions in large-scale spending bill. The U.S. House of Representatives

approved a package of spending legislation that contains measures to

provide protections for banks that work with state-legal cannabis

businesses and allow the legalization of marijuana sales in Washington,

D.C., among many other drug policy provisions. The appropriations

legislation and attached reports also direct federal government agencies to

reconsider policies that fire employees for using cannabis in compliance

with state law, criticize restrictive hemp regulations, encourage CBD to be

allowed in foods and urge expanded research on marijuana and other

substances. The legislation restricts the use of certain funds to punish

banks for working with marijuana businesses. Read More (Marijuana Moment)

Proposed tax rates in Schumer’s marijuana reform bill elicit

‘sticker shock’. The draft bill outlining Senate Majority Leader Chuck

Schumer’s federal marijuana reform legislation sets a nationwide MJ excise

tax that would rise from 10% to 25% over five years, a top rate that

industry officials argue would be overly burdensome to operators as well as

too high to combat illicit operators. The Cannabis Administration and

Opportunity Act – unveiled earlier as a 163-page “discussion draft” – would

legalize marijuana by removing it from the federal Controlled Substances

Act. That means it would eliminate Section 280E, the provision in the

Internal Revenue Service tax code that prevents marijuana businesses from

deducting the same ordinary business expenses that mainstream industries

can. But a 25% federal excise tax on marijuana – on top of any state and

local taxes – would hit growers especially hard, quite likely exceeding

their savings from the elimination of 280E, experts said. Read More (Marijuana Business Daily)

U.S. sports authority backs ‘liberalization’ of marijuana

laws, official tells lawmakers. A representative of the U.S.

Anti-Doping Agency (USADA) shifted blame for the Olympics suspension of the

U.S. runner Sha’Carri Richardson over a positive marijuana test, saying the

national sports organization is “heartbroken” over the case and supports

“liberalization” of current bans but claiming that its hands are tied with

respect to enforcing international drug policy. Justin Strekal, political

director for NORML, told Marijuana Moment: “USADA told Congress, right to

its face, that the policy of prohibition and stigmatization of cannabis

consumers is wrong. The remaining question is when will the House take

action to end the mandate that organizations like USADA, the DEA, ONDCP,

and others stop criminalizing otherwise law-abiding Americans?” Read More (Marijuana Moment)

How cannabis became illegal. It actually wasn't until 1970 that

cannabis, by virtue of being declared a Schedule l drug, officially became

illegal and of no medicinal value. In the 33 years between 1937 and 1970,

cannabis was not, technically, illegal. The Marijuana Tax Act of 1937 did,

however, make it illegal to produce, possess, or consume cannabis without

the permission of the federal government—as expressed in the form of a

special cannabis tax stamp. Interesting, the Marijuana Tax Act did not

explicitly outlaw cannabis. Rather, it failed to distribute the tax stamps

that legally permitted its cultivation and distribution, creating a de

facto prohibition at the federal level. In December 2018, a new Farm Bill

was passed by Congress which legalized hemp—although under relatively

strict regulatory oversight for which the traditionally anti-cannabis Drug

Enforcement Administration (DEA) plays a role in crafting and enforcing.

Read More (Higher Learning LV)

Does big business provide a better look into cannabis reform

than Capitol Hill? Operators believe so. Cannabis operators and executives tell

Benzinga that the movement of private and public companies may serve as a

better indicator of regulatory activity than the federal government. At the

very least, they say that the industry has made advancements so far without

the efforts of Capitol Hill. Poseidon Asset Management managing director

Emily Paxhia recently mentioned that she and her firm are tracking the

steps of private companies, cannabis and otherwise, noting which prominent

brands are supporting the cannabis industry. Operators in various sectors

of cannabis feel that the industry provides a better insight into

regulatory needs and movements than lawmakers. Read More (Markets Insider)

Billionaire Charles Koch on why cannabis should be legal. Depending on whom you ask,

Charles Koch is a titan of industry, dark money political bogeyman or the

Marcus Aurelius of the libertarian movement. But soon Koch might be known

as the billionaire who persuaded Republican and Democratic holdouts to

legalize cannabis at the federal level. Although Koch isn’t big on

consuming it himself, he’s going public now with a long-held belief:

Cannabis should be legal nationwide. So he’s putting his name, and nearly

$25 million of his $45 billion fortune, to influence criminal-justice

reform and legalization by the end of 2021. Charles Koch said:

“[Prohibition] is counterproductive. It ruins people’s lives, creates

conflict in society and is anti-progress. The whole thing never made sense

to me.” Read More (Forbes)

|

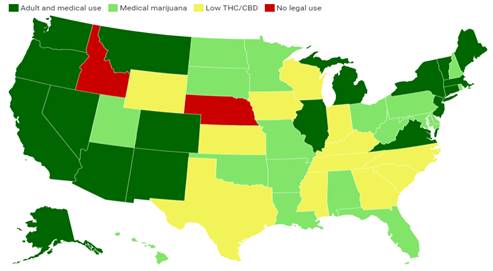

Chart 3: Cannabis Laws by State

|

|

|

Source: Intro-act, Will Yakowicz,

National Conference of State Legislatures and Marijuana Policy Project,

Datawrapper, Forbes

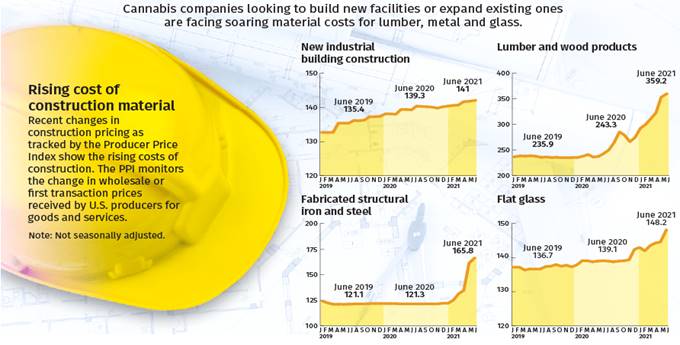

Cannabis firms face surging costs for building materials,

complicating plans. Cannabis growers, manufacturers and retailers planning to

build new facilities or expand existing ones are facing not only soaring

costs for materials but also lengthy wait times to get their projects off

the ground. And it’s not just the global COVID-19 pandemic that’s causing

the increased cost and supply shortage for both marijuana and mainstream

businesses, said David Fettner, principal of Highwood, Grow America

Builders, a construction company serving the cannabis industry. Wholesale

steel prices, for example, rose 36% during the first six months of the

year, according to federal data. Lumber prices in June were up 23% from

January and 48% from June 2020. Read More (Marijuana Business Daily)

|

Chart 4: Surging Construction Costs

|

|

|

Source: Intro-act, U.S. Bureau of Labor

Statistics’ Producer Price Index, Marijuana Business Daily

Ohio lawmakers introduce bill to legalize recreational

cannabis.

Two Democratic state lawmakers in Ohio introduced a bill to legalize

recreational cannabis. According to Toledo TV station WTVG, the measure

would establish a 10% excise tax on gross receipts of marijuana retailers. The

bill sponsors – state Reps. Casey Weinstein and Terrence Upchurch – said

they’re hopeful the measure will pass with bipartisan support. But at least

two Republican lawmakers told WTVG they’re staunchly opposed to legalizing

recreational marijuana. The move follows an announcement that a group of

cannabis advocates have launched a campaign to put adult-use cannabis on

Ohio’s 2022 ballot. Read More (Marijuana Business Daily)

Maryland plans recreational cannabis vote in 2022 elections. Marijuana is becoming a

fixture during political rallies, campaigns, and legislative plans. You

don’t have to wonder why this is the norm because there is a heightened

global interest in cannabis, with different states and nations committing

to studying and harnessing its potential through legalization. Maryland is

taking the same approach as its lawmakers are planning cannabis

legalization measures for their 2022 elections. The lawmakers announced

that the legislative arm of government would rely on voters on marijuana

policy reform. They intend to do this by putting cannabis legislation

measures on a statewide ballot in 2022. The Maryland House of Delegate

Speaker, Adrienne A. Jones issued a statement stating that she will create

a legislative workgroup to start studying the conditions around cannabis

legalization. Read More (Cannabis.net)

Illinois finally issues long overdue cannabis licenses. Governor J.B Pritzker’s

office announced the issuance of 200 new licenses for craft growers,

product manufacturers, and distributors that were originally to be issued

last year, according to Capitol News Illinois. The report stated that 67%

of the new licenses will go to people of color, helping fulfill part of the

social equity program first proposed in the state’s adult-use legalization

measure, which was passed into law in 2019. Additionally, Pritzker signed into

law Illinois House Bill 1443, which establishes three lotteries for

retailer licenses. The first is essentially a do-over of one conducted last

year, the 75 retailer licenses from which were never issued due to

litigation over the license-scoring process. Two additional lotteries will

award 55 retailer licenses each. Read More (Cannabis Benchmarks) and More (Grown In) and More (Marijuana Business Daily)

Idaho officials clear marijuana activists to collect

signatures for revised legalization ballot measure. Idaho officials have

cleared activists to begin collecting signatures for a revised initiative

to legalize possession of marijuana that they hope to place before voters

on the 2022 ballot. After being reviewed by the state attorney general’s

office, the latest version of the measure was uploaded to the secretary of

state’s website in final form along with official short and long ballot

titles. Meanwhile, a separate campaign to legalize medical cannabis in the

state is also underway, with advocates actively collecting signatures to

qualify that measure for next year’s ballot. The attorney general

previously outlined a number concerns on potential legal issues with the

adult-use measure and made non-binding recommendations for changes. Read More (Marijuana Moment)

Cuomo’s slow rollout of legalized weed becoming a real

buzzkill, critics say. New York’s legalized-pot program is on a train to nowhere —

apparently derailed because Gov. Andrew Cuomo is fuming over his stalled

plans to overhaul leadership at the MTA. Cuomo and the state legislature

approved the legalized sale of weed in New York in March, but the governor

has since become a real buzzkill on the issue, critics say. He has yet to

nominate an executive director for his new Office of Cannabis Management or

name appointees to the Cannabis Control Board, even though the Marijuana

Taxation and Regulation Act was passed months ago. Cuomo spokesman Richard

Azzopardi said: “We agree there’s a lot of unfinished business with the

Senate, and we’re ready to submit our nominations, and we hope they

reconvene and act on these and our MTA legislation and nominations.” Read More (New York Post)

Illegal cannabis growers are stealing water amid California’s

drought, officials say. California’s deepening drought is creating another big problem

for authorities: water theft. Water thieves, many of them illegal marijuana

growers, are tapping into fire hydrants and drilling unauthorized water

wells, according to officials, threatening the water supply for residents.

In a recent sting in Antelope Valley in northern Los Angeles County,

federal, state and local law enforcement officers disrupted hundreds of

allegedly illegal marijuana cultivations in the area. They arrested 131

people and seized 65 vehicles, including two water trucks. Authorities

recovered $28,000, 33,480 pounds of marijuana and dozens of firearms.

Nineteen people were charged with water theft. Water thieves, many of them

illegal marijuana growers, are tapping into fire hydrants and drilling

unauthorized water wells, according to officials, threatening the water

supply for residents. Read More (The Washington Post)

Cannabis industry in New Mexico faces big water challenge. All prospective cannabis

producers in New Mexico must prove they have rights to water and an

adequate supply before they can apply for a license, the Santa Fe New

Mexican reported. That can be a problem, especially for rural growers, in a

state with complicated laws divvying up a limited supply of water rights

and in the throes of a 20-year megadrought that threatens to contribute to

a serious water shortage. While cannabis growers who plan to operate in

facilities within a city can tap into the municipal water supply as

commercial customers, those growing outside city limits must purchase or

lease commercial or agricultural water rights from someone else who owns

them — a difficult and time-consuming process. A domestic well on private

property does not satisfy the requirement. Read More (Antelope Valley Press)

New Mexico likely to run out of cannabis after legal sales

begin. The

head of the state agency charged with overseeing New Mexico's upcoming

recreational cannabis industry told lawmakers to prepare for the

"Krispy Kreme syndrome." Linda Trujillo, superintendent of the

Regulation and Licensing Department, said: "It's highly likely we will

run out of cannabis in the first week, if not the first two weeks"

after legal sales begin. Comparing expectations of the new market, expected

to start by April, to reports of people waiting in line for hours before

the opening of a new Krispy Kreme franchise, Trujillo said the initial

demand will diminish over time. The Regulation and Licensing Department has

not yet released proposed rules for retailers, and its Cannabis Control

Division has not yet completed appointments to the Cannabis Regulation

Advisory Committee, which is tasked with providing guidance on the

industry's rules. Read More (The Santa Fe New Mexican)

Michigan credit union to offer banking services to marijuana

companies. The

Frankenmuth Credit Union in Michigan launched a product to provide banking

to marijuana companies in the area, only months after regulators went after

another financial institution for a similar move. According to the Detroit

Metro Times, the credit union created Envy, a pilot program dedicated to

servicing cannabis businesses and unveiled a plan to add one or two new

marijuana-related business members each month for the remainder of 2021.

The credit union, which services roughly 60,000 people, is partnering with

Green Check Verified, a financial technology company that enables financial

institutions to “safely and efficiently” offer services to legal marijuana

businesses. Read More (Marijuana Business Daily)

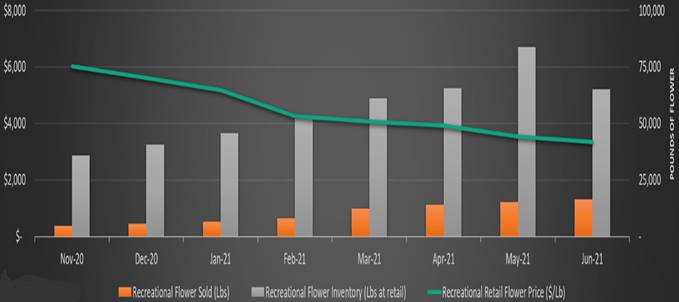

Michigan is the state of opportunity for private marijuana

operators. Despite

being a top cannabis market in the U.S., Michigan largely has been ignored

by multistate operators because of the low barriers to entry for new

licensees. However, with plenty of market growth and heavy fragmentation

across the supply chain, the state offers a compelling opportunity for

efficient private operators. The fragmentation, in turn, has caused price

compression. Initially, this was offset by consumer demand, with

recreational sales per dispensary peaking at $5 million in April 2021.

However, demand has slowed in recent months, and prices have continued

their decline. This highly competitive environment has kept most publicly

traded companies away from Michigan. Read More (Marijuana Business Daily)

|

Chart 5: Michigan Retail Flower Price Versus

Quantity Sold and Inventoried

|

|

|

Source: Intro-act, MjResearchCo,

Marijuana Business Daily

Colorado launches Cannabis Business Office to assist MJ

companies. Colorado

is forming a new state agency, the Cannabis Business Office, designed to

provide more governmental support to marijuana companies, particularly

social equity entrepreneurs. The new department, announced by Colorado Gov.

Jared Polis, will dole out loans and grants to social equity cannabis

entrepreneurs and provide technical assistance to MJ business owners. The

Cannabis Business Office will be an arm of the Colorado Office of Economic

Development and International Trade. The agency was created just this year

by the Colorado legislature with the passage of Senate Bill 111. In a

statement, Polis said the creation of the department is part of his overall

goal of making Colorado a national cannabis industry leader. Read More (Marijuana Business Daily)

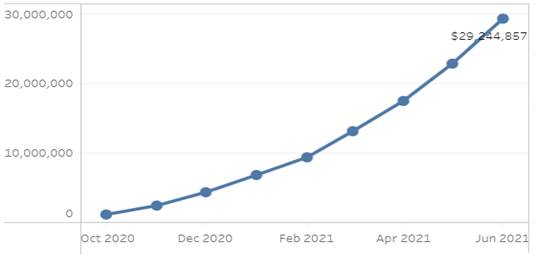

Maine’s recreational marijuana industry saw record $6.4

million sales in June. Maine’s adult-use marijuana industry had another

record-breaking month in June, with nearly $6.5 million sold in June. From

first-timers to regular customers, there’s growing demand for marijuana in

Maine. Statewide, retail sales reached $6.47 million in June, up more than

a million dollars from May. Erik Gundersen, director of the Maine Office of

Marijuana Policy said: “Taking a look at some early data, we expect the

same thing for July, so it’s incredibly encouraging. Consumers are starting

to choose the regulated, tested, tracked marketplace for cannabis”. He said

access is expanding, with 45 active retail stores and around 50

municipalities opting-in. Read More (Bangor Daily News) and More (Maine.gov)

|

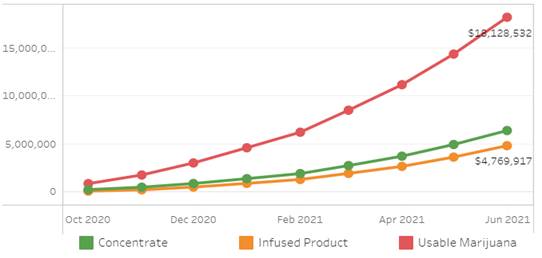

Chart 6: Sales Amount

|

|

|

|

Chart 7: Sales Amount – By Product Category

|

|

|

Source: Intro-act, Maine.gov

Medical marijuana sales in Arkansas hit $365 million, state

officials expect tallies to top $400 million by fall. Medical marijuana sales

keep climbing in Arkansas, and state officials expect the figures to keep

getting higher. New figures released from the Arkansas Department of

Finance and Administration show the state hitting $365 million in overall

sales from 54,009 pounds of product. Those numbers are an increase of $26.5

million and 3,924 pounds since June’s data, which reported $338.5 million

and 50,085 pounds in sales. As of July 23, there are 78,754 active patient

cards in the state. That’s a 1,081 increase over the 77,673 reported in

June. That increase in patients and dispensaries has state officials

predicting continued growth in state revenue from medical marijuana in the

Natural State. DFA spokesperson Scott Hardin said: “We anticipate sales

will reach $400 million by September 1”. Read More (KARK.com)

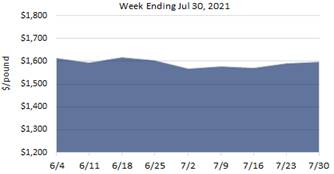

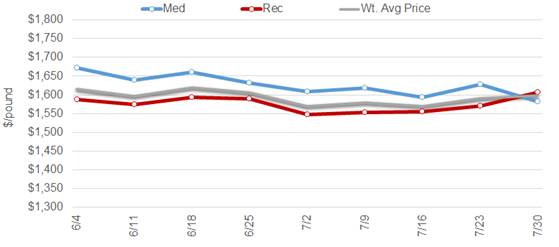

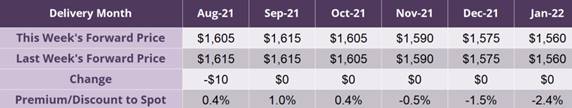

The U.S. cannabis spot index increased 0.5% to $1,598 per

pound, August 2021 implied forward down $10 to close at $1,605 per pound. The simple average

(non-volume weighted) price increased $27 to $1,881 per pound, with 68% of

transactions (one standard deviation) in the $1,063 to $2,699 per pound

range. The average reported deal size increased to 2.6 pounds. In grams,

the Spot price was $3.52 and the simple average price was $4.15. The

average reported forward deal size was 62.5 pounds. The proportions of

forward deals for outdoor, greenhouse, and indoor-grown flower were 53%,

35%, and 11% of forward arrangements, respectively. The average forward

deal sizes for monthly delivery for outdoor, greenhouse, and indoor-grown

flower were 78 pounds, 50 pounds, and 30 pounds, respectively. Read More (Cannabis Benchmarks)

|

Chart 8: Cannabis Benchmarks U.S. Spot Index

|

Chart 9: Cannabis Benchmarks U.S. Implied

Forward Curve

|

|

|

|

Source: Intro-act, Cannabis Benchmarks, New

Leaf Data Services

Legal cannabis industry in Oklahoma funds more enforcement

efforts as criminals 'make us look bad'. With a more open cannabis industry in

Oklahoma spurring organized crime concerns, state agencies say they need to

team up and expand compliance and enforcement efforts with funding provided

from the fees paid by medical marijuana businesses operating legally. An

Oklahoma Medical Marijuana Authority-licensed Garvin County grower told the

Tulsa World: “We need to make sure bad actors are not here. For those of us

who live and breathe these rules every day, it makes us look bad.”

Officials with OMMA and the Oklahoma Bureau of Narcotics are hopeful a new

memorandum of understanding between the two organizations, despite their

differing roles, will improve efforts to efficiently block illicit activity

— whether from within the state’s medical program or otherwise. Read More (Tulsa World)

Elon Musk, Jeff Bezos & Richard

Branson: which market leaders will make up the cannabis industry space

race? As

billionaires like Elon Musk, Jeff Bezos and Richard Branson race for space,

who will be the leaders in the nascent cannabis industry as it vaults to

astronomical heights? Operators in various parts of the cannabis industry

offered Benzinga their takes. Providing various responses, most focused

less on the people and more so the brands and companies that could be

headed to the moon, of sorts. Olivia Alexander, CEO of online global CBD

boutique Kush Queen, compared the industry to the dot com bubble and said:

"At this stage, the industry is so young with so much room for

innovation and expansion it is very hard to say how many players are going

to remain once the market begins to mature and fully develop on a federal

level." Read More (Markets Insider)

Canadian cannabis producers have sold less than 20% of output

since adult-use legalization. Cannabis producers in Canada have sold less than 20% of

their production since the country launched adult-use sales in October

2018, according to an MJBizDaily analysis. The newest data – which runs

through 2020 – implies that most of the cannabis produced from 2018 through

last year was either stored in inventory or destroyed, and less than

one-fifth ended up in retail stores. That disconnect likely helps explain how

the largest Canadian cannabis producers, which account for most of the

industry’s production, together have lost more than CAD $11 billion ($8.8

billion) cumulatively. Roughly 2.7 billion grams (2,976 tons) of cannabis

were produced in Canada between October 2018 and December 2020, but

MJBizDaily estimates that approximately 450 million grams reached store

shelves. Read More (Marijuana Business Daily)

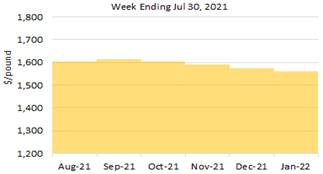

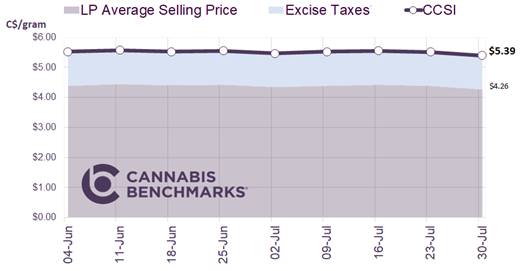

Cannabis stores on rise in Canada. The number of stores

continues to climb steadily across the country, making the legal cannabis

system more accessible to consumers. Our latest count shows the number of

stores open for business reached 2,277 as of the end of July. This is up by

1,255 stores, or a jump of 123%, compared to July 2020. As can be seen in

the chart below, Cannabis Benchmarks expect that trend to continue

throughout this year. Cannabis Benchmarks expected Alberta’s store count to

plateau in the second quarter of this year, but the store count there has

continued to grow. Quebec currently has 89 cannabis retail locations, which

is a 106% increase from last year, and we expect the store count there will

expand to 104 retail locations by the end of the year. Read More (Cannabis Benchmarks)

|

Chart 10: Cannabis Retail Store Count by

Province

|

|

|

Source: Intro-act, Cannabis Benchmarks,

New Leaf Data Services

Older, higher and fewer newbies: four new trends in Canada's

cannabis market. 1) More older users: While there was a presumption during the

early days of legalization that older Canadians were a mostly

"canna-curious" group, and that most sales would occur from a

younger demographic, Brightfield found that the average consumer age has

increased over the past year, 2) High demand for high THC: Canadian

cannabis users who prefer their products with THC were found to be the most

frequent consumers, with 48 percent of those so-called "THC-dominant

consumers" using marijuana at least once daily, while 28 percent of

them said they consume multiple times a day, 3) Fewer newbies: The amount

of new people entering the cannabis market is trending down, a sign that

the total consumer base may be plateauing in the Canadian market, and 4)

Illicit market shift: Ontario cannabis consumers are increasingly moving

away from the illicit market and engaging more with legal retail options as

they become more widely available and convenient, according to

Brightfield's data. Read More (BNN Bloomberg)

|

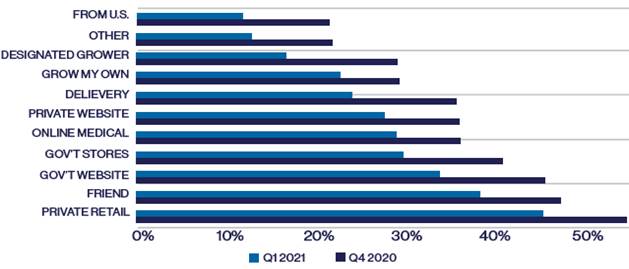

Chart 11: Shifting Sources: Where Canadians Buy

Their Cannabis

|

|

|

Source: Intro-act, Brightfield Group,

BNN Bloomberg

COVID-19

COVID cannabis consumption expected to remain high even after

pandemic. Cannabis

producers in Canada have sold less than 20% of their production since the

country launched adult-use sales in October 2018, according to an

MJBizDaily analysis. The newest data – which runs through 2020 – implies

that most of the cannabis produced from 2018 through last year was either

stored in inventory or destroyed, and less than one-fifth ended up in

retail stores. That disconnect likely helps explain how the largest

Canadian cannabis producers, which account for most of the industry’s

production, together have lost more than CAD $11 billion ($8.8 billion)

cumulatively. Some industry experts blame poor-quality cannabis for the

sales shortfall. Read More (Marijuana Business Daily)

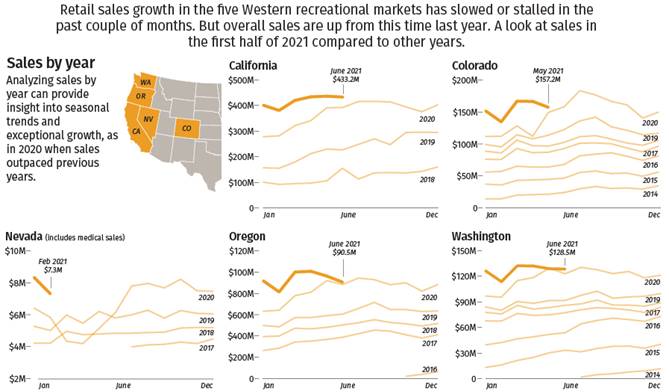

Boom or bust? Marijuana execs see more sales gains as COVID-19

lockdowns ease. While marijuana sales have slowed the past couple of months –

raising questions about whether a boom in coronavirus-related cannabis

purchases is petering out – industry executives are bullish and note that

sales remain up versus a year ago. And while recreational sales in some key

states have begun to show signs of flattening, they remain above levels

seen a year ago, according to Seattle-based data-analytics firm Headset. In

California, for example, adult-use sales in June eased 0.8% from May but

were up 10.4% versus June of last year. Ditto in Oregon, where sales in

June were off 6% from May but up 2.4% from a year earlier. And in

Washington state, June sales were off 0.3% from May but up 4.5% from a year

earlier. Read More (Marijuana Business Daily)

|

Chart 12: Adult-Use Sales Soften but Up

Year-Over-Year

|

|

|

Source: Intro-act, State Marijuana

Regulatory Agencies, Headset

COMPANY NEWS

Tilray reports $336 million annual loss, targets $4 billion in

cannabis sales by 2024. Tilray (TLRY) reported an annual loss of $336

million (CAD $422 million) for its fiscal year ended May 31, capping off a

transformative year in which the company closed a reverse-merger with

Aphria and bought U.S SweetWater Brewing Co. On a quarterly basis, net

revenue increased 16% over the previous three-month period to $142 million,

helping the company post net income of $33.6 million while adjusted EBITDA

was $12.3 million. In a conference call with analysts to discuss the

quarter, CEO Irwin Simon said Tilray is aiming to achieve $4 billion in

sales by the end of 2024. He said the forecast includes expected sales in

the U.S. of up to $1.5 billion. Read More (Marijuana Business Daily)

Tilray CEO breaks down the future of the cannabis industry. Tilray (TLRY) CEO Irwin Simon talks with Julie

Hyman on the integration of Tilray and Aphria thus far, and his vision for

the company and cannabis industry heading into a post-pandemic world He

said: “When you think of cannabis, you think adult use, and what it

ultimately does from relaxation from giving you a little energy high, et

cetera, and cannabis, also, used in lots of different medical formats and

medical reasons.” He added: “You know, the natural organic food industry

was about a $60 billion industry, so the cannabis industry is a much bigger

industry, a much bigger opportunity. My playbook here is to create the

largest cannabis company that's built around consumer brands, and those

brands will be built around adult use. It will be built around medical

cannabis. It will be built around drinks, edibles, and food.” Read More (Yahoo!)

Houseplant and Canopy Growth to conclude their strategic

relationship in Canada. After three years of a successful joint venture, Houseplant

and Canopy Growth (CGC) have mutually agreed to

end their relationship. The Canadian cannabis market has evolved

substantially during this period, and the parties believe the time is right

for the Houseplant brand to develop independently while Canopy advances its

focus on wholly-owned brands for the Canadian market. The relationship

between Houseplant and Canopy started in 2018, well ahead of Canadian

legalization. Since that time, Houseplant and Canopy worked together to

pave the way in defining a premium cannabis experience in a new market.

During the course of their relationship, Houseplant has become a popular

consumer brand in Canada and is currently a top 10 brand in the premium

cannabis market in Ontario. Read More (Newswire)

Aurora Cannabis continues board revamp, installs ex-Pfizer

executive.

Aurora Cannabis (ACB) expanded its board and

installed Theresa Firestone, a senior health-care executive, as an

independent director. Firestone joins Aurora after overseeing the launch of

Shoppers Drug Mart’s medical cannabis business. Shoppers, owned by

supermarket giant Loblaw Cos., is the largest pharmacy chain in Canada.

Previous to Shoppers, Firestone held senior roles at pharmaceutical and

biotechnology firm Pfizer, including acting as regional president, Asia,

according to her LinkedIn profile. Aurora chair Ronald Funk said in a

statement that Firestone “brings to us extensive expertise in healthcare

management and pharmaceuticals, global business restructuring, new business

development and a proven ability to lead and manage change”. Read More (Marijuana Business Daily)

GrowGeneration signs asset purchase agreement to acquire chain

of hydroponic garden centers. GrowGeneration (GRWG) entered an asset purchase

agreement to acquire HGS Hydro, the nation's third-largest chain of

hydroponic garden centers, with six stores across Michigan and a seventh

store slated to open in the fall of 2021. This transaction is expected to

close before the end of fiscal year-end 2021. Founded in 2015 by Rocky

Shaeena, HGS Hydro is the largest chain of hydroponic garden centers in the

state of Michigan and generated approximately $50 million in revenue in

2020. When completed, the transaction will also bring the total number of

GrowGen hydroponic garden centers in Michigan to 14 and the total number of

stores to 65. Read More (GrowGeneration)

Clever Leaves and Biopharmaceutical Research Company to

partner for landmark cannabis research study. Clever Leaves Holdings

Biopharmaceutical Research Company announced a joint partnership with the

intent to study the DNA sequence variation of three Clever Leaves’ cannabis

cultivars as part of their Project Change Lives campaign. Project Change

Lives is the U.S.-based initiative sponsored by Clever Leaves, whereby the

company has pledged to contribute up to $25,000,000 retail value of medical

cannabis products to any eligible U.S. organization to help advance

scientific research into the potential medical benefits of cannabinoids. By

sponsoring Project Change Lives, Clever Leaves is offering to provide a

historic amount of pharmaceutical-grade cannabis to leading research

institutions in one of the most advanced pharmaceutical markets in the

world. Read More (Yahoo!)

Verano to expand Nevada presence with $29 million acquisition

of Sierra Well. Verano Holdings entered into an agreement to acquire all of

the equity interests of WSCC, Inc., d/b/a Sierra Well, adding two

operational dispensaries and an active cultivation and production facility

in Nevada along with two real estate properties in Carson City and Reno.

Both dispensaries are situated along busy retail corridors and just minutes

from their respective city centers. Closing on the transaction is subject

to customary conditions, contingencies, and approvals, including regulatory

approval. The transaction is expected to strengthen distribution capability

in Northern Nevada with the addition of an approximately 10,000 sq. ft.

Reno cultivation and production facility, complementing active expansion at

the Verano-affiliated cultivation facility in North Las Vegas. Read More (New Cannabis Ventures)

Harvest One eyes global expansion for new cannabis-infused

products.

With its 2018 acquisition of Dream Water, Harvest One (HRVOF) gained instant access to

30,000 North American retail outlets and an emerging e-commerce business.

The brand already had gained considerable recognition by the time Harvest

One acquired it and since then, Dream Water has added more than 11,000 new

distribution points across the U.S. In February, the company signed a major

Asian distribution agreement, gaining access to Golden River’s massive

distribution network that includes retail partners across China and other

Asian countries, e-commerce platforms with a total of over 500 million

active monthly users and airlines. With its expanding portfolio of

cannabis-infused topical creams and its plan to develop other innovative

products that aid in sleep and relaxation under its acquired Dream Water

brand, Harvest One demonstrates a strategy aimed at those exact consumer

demands. Read More (Benzinga)

Bootstrapped edibles company Wana Brands on track to double

markets served by year-end. Wana Brands which is currently in 11 states in the

U.S., soon to be 12. The company is launching in Massachusetts in early

September, according to co-founder and CEO Nancy Whiteman. With more

agreements either signed or close to being signed, the company will be in

16 states by the end of the year or early 2022. In addition to its U.S.

footprint, Wana has market reach in Canada through its manufacturing

partnership with Indiva (NDVAF). Wana has approximately 45% market

share in the gummy space in Canada. Through that partnership, Wana has been

able to bring its U.S. products to the Canadian market, and it will be

looking to introduce more innovative products to Canada over the next six

to eight months. Read More (New Cannabis Ventures)

Lowell Farms looks to leverage its brand power in California

and beyond following transformative M&A. Lowell Farms has a widespread

distribution reach in California, reaching up to Tahoe and Mammoth and down

to San Diego. The company operates 15 routes per day, some running five

days a week and others once a week. In total, Lowell Farms serves about 85

percent of licensed retailers in the state, according to Lowell Farms CEO

Mark Ainsworth. The company is also preparing now for the eventuality of

federal legalization and cross-border transactions. Lowell Farms has made

acquisitions and infrastructure decisions that will help it be ready for

that future, rather than waiting and being months behind other operators.

The company is taking its Lowell Smokes brand to Illinois and Massachusetts

through a licensing agreement with Ascend Wellness Holdings. Read More (New Cannabis Ventures)

Marijuana industry veteran Kris Krane leaving 4Front Ventures.

Kris

Krane, co-founder of 4Front Ventures (CNXXF) and president of Mission

Dispensaries, is stepping down after nearly 11 years with the Arizona-based

multistate operator. The transition was months in the making, according to

a news release, with Krane staying on as strategic adviser. 4Front doesn’t

plan to immediately fill Krane’s post as president of Mission Dispensaries.

Krane said in the release: “In the last 11 years, we went from a few people

in a room with an idea, to building a national, vertically integrated

cannabis operator with operations and facilities in strategic medical and

adult-use cannabis markets, including California, Illinois, Massachusetts,

Michigan and Washington.” He further continued: “I feel incredibly

fortunate to have played an instrumental role in 4Front’s journey.” Read More (Marijuana Business Daily)

Kanabo to be Europe's biggest public cannabis business after

takeover. Kanabo

said that it had agreed terms to buy the European operations of Materia.

Exact terms weren't disclosed but Kanabo said the deal would be paid for

through shares and subject to performance-related goals. Materia owns a

cannabis processing plant in Malta and a wholesaling business in Germany,

which is the largest market for legal marijuana in Europe. Materia's Malta

plant has contracts with around 20 producers globally and is currently

vetting them. In a statement to the stock market, Kanabo's chief executive

Avihu Tamir said: "Together with Kanabo's R&D and commercialization

capabilities, I expect this enlarged group to become the biggest public

cannabis company in the UK and EU and puts us in a unique position as the

multibillion pound medicinal cannabis market begins to grow in

Europe." Read More (Yahoo)

Flora Growth to partner with Avaria to distribute

award-winning pain cream brand KaLaya. Flora Growth has signed a non-binding

Letter of Intent to form a joint venture with Avaria, the manufacturer and

owner of KaLaya – an award-winning pain cream distributed nation-wide

across Canada. Through the JV, Flora Growth will manage registration,

sales, and distribution of KaLaya products in Colombia, Mexico, and other

LATAM countries, while Avaria will supply finished product to the JV.

Further, Flora Lab will work to produce KaLaya’s CBD-infused products using

cannabis from Flora’s cultivation facility. These products are expected to

be distributed across LATAM using Flora Lab’s established distribution

channels, with the aim of exporting to the U.S. market, where Avaria is

currently launching the KaLaya brand. Read More (Technical420)

IM Cannabis expands position in Israel with $4.6 million

acquisition. On July 28, 2021, IMC Holdings concurrently executed

definitive share purchase agreements to acquire all of the outstanding

ordinary shares of each of: 1) Pharm Yarok, a leading medical cannabis

pharmacy located in central Israel, 2) Rosen High Way, a trade and

distribution center providing medical cannabis storage, distribution

services and logistics solutions for cannabis companies and pharmacies in

Israel, and 3) HW Shinua, an applicant for a medical cannabis

transportation license from the Israeli Medical Cannabis Unit. The

aggregate consideration for the Acquisition is approximately $4.6 million1

in cash, of which $1.3 million shall be invested in IMC in consideration

for IMC’s equity by the shareholders of Pharm Yarok, Rosen High Way and HW

Shinua. Read More (New Cannabis Ventures)

Pure Extracts receives sales license from Health Canada. Pure Extracts Technologies

announced that its wholly owned subsidiary, Pure Extracts Manufacturing,

has received approval from Health Canada to amend its license to permit the

sale of cannabis extract products to provincially authorized distributors

and retailers nationwide as well as to holders of licenses for the sale of

medical cannabis extracts. This approval is the result of an intensive

review by Health Canada of Pure Extracts’ internal systems, processes,

products and packaging. The company’s purchase orders from British

Columbia, Alberta, Saskatchewan and Ontario are currently being fulfilled

by its distribution partner, thus having its own sales license will allow

Pure Extracts’ products to eventually reach all provincial and territorial

jurisdictions across Canada without the help of an intermediary. Read More (GlobeNewswire)

Cannabis companies looking to grow have more options than

ever. Josh

Genderson, CEO of Holistic Industries, which operates in six states plus

Washington DC didn’t plan to take his medical marijuana business national,

but his first success highlighted the opportunities that awaited. Genderson

scaled Holistic Industries by winning licenses in limited markets and

establishing regional presence to build brand recognition. Success bred

capital raises that have allowed Holistic to add M&A to its scaling

toolbox, but securing licenses remains central to its strategy. Adam Berk,

the founder of food-delivery service company Osmio, which became Grubhub,

focused on establishing brands, proving them in a tough market and then

taking them into other states through M&As. The arrival of COVID-19

compelled Berk to update his strategy. Read More (Marijuana Business Daily)

Cannabis pharmaceuticals are hopeful as senate drafts bill to

legalize marijuana. As U.S. Senate leaders discuss a draft of a bill to legalize

marijuana on a federal level, giants in the cannabis industry are preparing

for what could be coming next. If passed, the Cannabis Administration and

Opportunity Act would remove marijuana from the Controlled Substances Act,

expunge federal convictions for nonviolent marijuana offenses and establish

a way to tax marijuana. It would also give cannabis pharmaceutical companies,

like the Tilray (TLRY), a chance to shine in the U.S. Tilray

CEO Irwin Simon told Yahoo Finance: “I see over the next 18-to-24 months

that cannabis in some format will have legalization.” Read More (International Business Times)

EARNINGS

Greenlane pre-announces Q2 revenue at $34.5 million. Greenlane Holdings (GNLN) announced preliminary

financial results for its second quarter ended June 30, 2021 with estimated

net sales of approximately $34.5 million. The company also anticipates gross

margin of 21% to 22% and total cash balance of approximately $11.5 million.

Primarily due to headwinds created by uncertainty in supply chain and

lingering impacts of Covid-19, the company suspended its illustrative pro

forma outlook provided on March 31, 2021, for the calendar year ending

December 31, 2021, and expects to reestablish a pro forma outlook at a

later date. Greenlane continues to expect the proposed merger with KushCo Holdings (KSHB) to close in the third

quarter of 2021, subject to the satisfaction or waiver of all remaining

conditions in the agreement, including the receipt of all necessary

approvals.” Read More (New Cannabis Ventures)

CAPITAL MARKETS

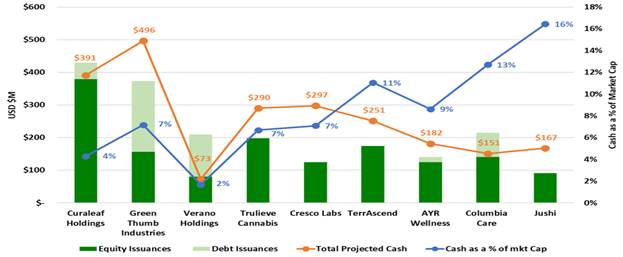

Projected June cash levels are high suggesting continuing

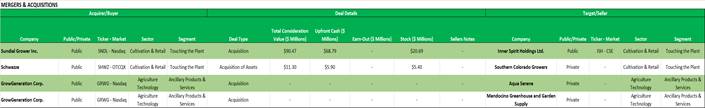

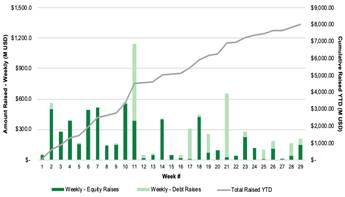

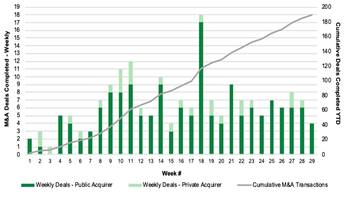

M&A acceleration. It’s no secret that 2021 has been a record year for the U.S.

Cannabis M&A activity and a robust year for the U.S. cannabis capital

raises. The graph shows YTD equity raises (dark green bar) and debt capital

raises (light green bar) for nine of the largest MSOs. The orange line on

the graph shows projected June cash balances. Viridian started with beginning

of the year cash, added capital raises, subtracted the cash component of

both closed and pending acquisitions and added actual free cash flow for Q1

and projected free cash flow for Q2. The blue line shows projected mid-year

cash balances as a percentage of market cap. High cash levels and

relative cash levels suggest continued strong M&A and capital spending

levels for the remainder of 2021 and beyond. Read More (Viridian Capital Advisors)

|

Chart 13: Capital Raises Provide Fuel for

Continued Acquisitions

|

|

|

Source: Intro-act, Viridian Capital

Advisors

Schumer's pot legislation could spark up cannabis IPOs on Wall

Street. A

bill introduced by Senate majority leader Chuck Schumer would remove

cannabis from the Controlled Substances Act, a process known as

descheduling. In doing so, lawmakers would open the door to a host of

financial services long denied to the industry. Banks and other financial

institutions—including stock exchanges—avoid doing business with the U.S.

marijuana companies in large part because of federal anti-money laundering

laws that criminalize financial transactions tied to illegal activity. But

a legislative overhaul may help pot companies to go public in the U.S.,

either by giving banks leeway or changing the drug's legal status. That

could set up a crucial exit option for privately backed cannabis companies,

ending the need for workarounds like listing shares in Canada or banking

with state-chartered credit unions. Read More (PitchBook)

MEDICAL CANNABIS

Congressional lawmakers push marijuana protections for all

states. An

amendment to protect all state and tribal marijuana programs from federal

interference now has 15 cosponsors after its bipartisan proponents

circulated a letter to build support. But a Republican opponent of reform

is pushing a dueling proposal to end a more modest, longstanding rider

that’s provided protections for medical cannabis states alone. Meanwhile,

Rep. Doug LaMalfa (R-CA) is taking the unusual step of filing a competing

measure that would cease federal protections for states with medical

cannabis legalization on the books—including his own—that have been in

place and renewed annually on a bipartisan basis since 2014. Read More (Marijuana Moment)

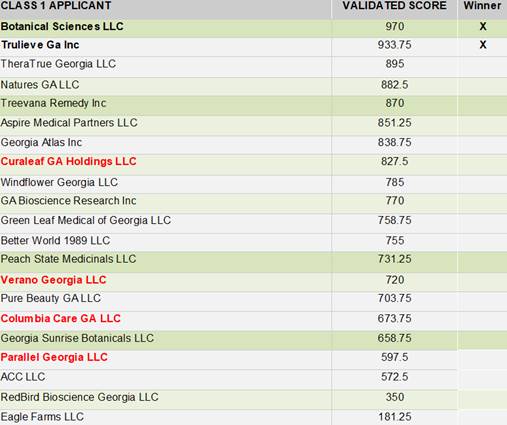

Georgia announces winners of six medical marijuana licenses. At long last the Georgia

Access to Medical Marijuana Commission chose six companies that will be

allowed to grow, manufacture and sell medical marijuana oil capped at 5%

THC. Each license holder will be allowed to open five dispensaries.

Botanical Sciences and Trulieve GA (TCNNF) won Class 1 Production

Licenses which allows for up to 100,000 square feet of cultivation space.

FFD GA Holdings (Fine Fettle Dispensary), Theratrue Georgia, Natures GA and

Treevana Remedy were awarded a Class2 License which permits them to

cultivate cannabis with 50,000 square feet of canopy. Read More (Cannabiz media) and More (Marijuana Business Daily)

|

Chart 14: List of Applicants with Validated

Score

|

|

|

Source: Intro-act, Cannabiz Media

License Database, Cannabiz Media

Public backs medical marijuana, South Carolina polls suggest.

Is that enough to convince lawmakers? Next year, South Carolina lawmakers

will debate and possibly vote to join nearly 40 states that legalize some

sort of medical marijuana. In this case, for use in oils and creams

prescribed by licensed doctors for people with some of the most-serious and

debilitating diseases and health problems. The state’s survey of South

Carolina’s 46 state senators found a majority, if not all, senators want to

have the debate. Yet, in addition to the bill’s 16 sponsors, three said

they were supportive or leaning toward voting for it. Eleven said they were

still studying the bill or hadn’t decided, while some of them acknowledged

the public support and the health benefits but wanted to see changes. Five

said they were likely to vote against and one declined to comment. Read More (Johnson City Press)

Mississippi lawmakers drafting medical marijuana measure. A Mississippi Senate

committee is close to finishing draft legislation to legalize medical

marijuana, two months after the state’s highest court struck down a

voter-approved, business-friendly bill, Lt. Gov. Delbert Hosemann said. The

development leaves open the possibility that Gov. Tate Reeves could call a

special session later this summer to address the issue, according to

WAPT-TV in Jackson and other media. The governor might feel pressure to do

so after voters in the Deep South state approved MMJ legalization by an

overwhelming margin at the ballot box in November. The measure, however,

isn’t expected to be nearly as pro-business as the voter-approved version.

Full details of the potential Senate bill weren’t disclosed. Read More (Marijuana Business Daily)

CBD/HEMP

Cannabis Administration And Opportunity Act: what the proposed

federal cannabis laws would mean for hemp. Senators Chuck Schumer (D-NY), Ron

Wyden (D-OR), and Cory Booker (D-NJ) released the discussion draft of

historic federal cannabis legalization legislation, the Cannabis

Administration and Opportunity Act (CAOA). The CAOA would not only end

cannabis prohibition but would also establish a regulatory framework for

cannabis under the U.S. Food and Drug Administration (FDA) and the Alcohol

and Tobacco Tax and Trade Bureau (TTB). It also includes comprehensive

restorative justice provisions, including grants, loans, and other funding

programs for disadvantaged and minority businesses, record expungement,

petitions for resentencing, and other measures intended to repair the

decades of harm caused by the War on Drugs. Read More (JD Supra)

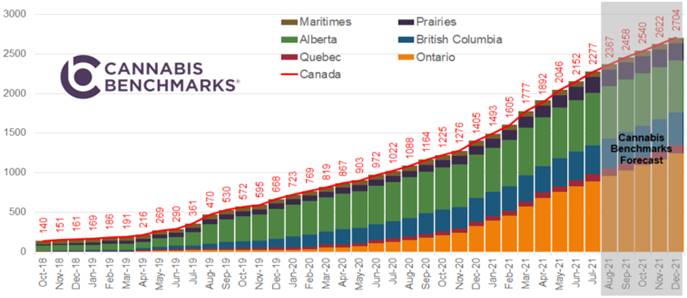

Market participants report increased CBD sales on demand for

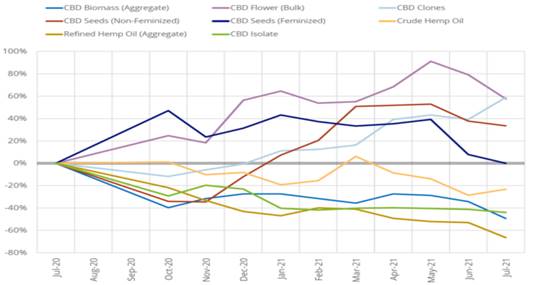

delta-8 THC, but prices continue to slide. July month saw continued

erosion in wholesale hemp cannabinoid product prices for the most part.

Crude CBD Oil and Broad Spectrum CBD Distillate were the only extracted

hemp cannabinoid products to see price rises in July, but rates for each

remain well below those observed just a few months ago. Observed rates for

Delta-8 THC distillate have also resumed a downward trend in the face of

consistent demand. July month’s observed average per-kilogram price was

down 12% from June. Individual transactions ranged from $800 per kilogram

to $1,600 per kilogram, with both the low and high ends of the range down

from last month. Read More (Hemp Benchmarks)

|

Chart 15: July 2021 Spot Price Index Report

|

|

|

Source: Intro-act, New Leaf Data

Services, Hemp Benchmarks

CBD industry needs regulation to bring legitimacy. When it comes to CBD,

entrepreneurs would be well served to start with the end in mind. The

foreseeable outcome is federal regulation – just like any other consumed

food or dietary supplement on the market. While it is understandable that

CBD manufacturers would prefer to run their businesses without any

government intervention, being left unchecked has made the sector

vulnerable to unscrupulous behavior. Without regulation in place, anyone

can sell CBD products. If regulatory history has taught us anything, it is

that when it comes to problems with health and wellness supplements,

regulation often stimulates improvements in public health. In addition,

regulation brings legitimacy to the industry, which is just what the

industry needs to spur the next big surge of confidence in CBD. Read More (Hemp Industry Daily)

Here’s how Delta-8’s popularity is dividing NC’s fledgling

hemp industry. One of the hottest new cannabinoids on the market is dividing

North Carolina’s fledgling hemp industry. Enter Delta-8 THC, otherwise

known as “Weed’s Little Brother.” It’s the less-potent, less well-known

cousin of Delta-9 THC, the chief psychoactive compound in marijuana, and

it’s a booming business, especially in states like North Carolina, where

marijuana remains illegal. Proponents say Delta-8 is a safe and legal

alternative for consumers seeking an intoxicating buzz thanks to the 2018

Farm Bill that legalized hemp and its derivatives. But critics question how

legal it is, and believe it’s a way to skirt federal law that currently

bans Delta-9. Given the regulatory gray area, some local hemp farmers are

steering clear. Read More (WRAL TechWire)

Consumer brands coalition steps up CBD pressure. A coalition of consumer

brands that includes Coca-Cola, PepsiCo and Kellogg is appealing to the

U.S. health regulators to get going on regulations to allow

over-the-counter CBD. The July 22 letter from the Consumer Brands

Association argues that the current U.S. policy on CBD “is not working”

because CBD is not allowed in foods, drinks and dietary supplements, but

such products are nonetheless commonly sold by companies flouting

regulations from the U.S. Food and Drug Administration. The group wrote:

“FDA inaction is resulting in a marketplace full of CBD-containing products

produced in establishments that escape FDA regulation.” Read More (Hemp Industry Daily)

Hemp having a moment as farmers try to grow niche crop into

$1-billion industry. The southern Alberta farmer has been growing hemp for 12

years, and in the early days, the distinctive odor that wafts from his

fields when the crop is in flower would invariably catch the attention of

area residents. According to Health Canada, which licenses and regulates

the industrial hemp industry in this country, there were about 22,000

hectares (50,000 acres) of hemp seeded in Canada in 2020, up from just

2,400 hectares (5,900 acres) in 1998. Canadian hemp exports exceeded

$110-million in 2019, and Manny Deol, executive director of the non-profit

Alberta Hemp Alliance says he believes this country could have a $1-billion

industry by 2030, if it does everything right. He says investors appear to

think so too, given the number of new processing facilities recently

constructed or proposed. Read More (Yahoo!)

Concentrated CBD? THC-O? As states limit delta-8 THC, industry

operators plan next steps. As state limits on hemp-derived delta-8 THC begin to

impact sales for product manufacturers and retailers, businesses are

considering how they will make up the gap. Delta-8 THC has taken the industry

by storm over the past 18 months, as manufacturers, stuck with a glut of

low-priced CBD distillate and isolate, synthesized the product into the

popular intoxicant. Because delta-8 THC is being banned specifically,

manufacturers are making a derivative substance that isn’t barred, James

Stephens, a chemical engineer and microbiologist and founder of Iron Light

LLC in Missoula, Montana said. He continued: “It’s the same kind of game

you see with a lot of the designer drug laws. Remember all the synthetic

cannabinoids that were on the market?” Read More (Hemp Industry Daily)

Hemp included in New York program backing fiber production. Hemp is now included in a

New York state program aimed at supporting fiber-based textiles. A new law

put hemp, wool, alpaca, cashmere and linen in the state’s Grown and

Certified Program, from which they can receive seals of approval. The law builds

on an existing program designed to develop local agricultural supply chains

in the state and promote New York farm products. The expansion of the Grown

and Certified Program is part of a strategy to promote the state’s fiber

industry through marketing and continuing infrastructure development, said

Assemblywoman Donna Lupardo. She continued: “It is an important step that I

hope adds momentum to a new and exciting ‘farm to fashion’ movement

building in NYS.” Read More (HempToday)

Washington will certify extracts produced for sale in other

states. Washington

state’s Department of Agriculture will begin to certify hemp extracts, in a

move officials say will help producers sell products in other states. Under

the new program, processors who want to produce hemp extract for use as a

food ingredient may apply for a hemp extract certificate that assures

compliance with Washington’s inspection and good manufacturing practices

requirements. But those products may only be sold out of state. The

Industrial Hemp Association of Washington, which backed the new law, had

said processors were being shut out of other states because of the lack of

a formal hemp production program. But the new law also affirms that CBD and

other hemp cannabinoids are prohibited in food in Washington until the U.S.

Food & Drug Administration (FDA) clarifies the status of hemp extracts

in food. Read More (HempToday)

Idaho preparing hemp plan for USDA approval. Idaho aims to submit its

hemp plan to the U.S. Department of Agriculture by September 1. First,

Idaho State Department of Agriculture (ISDA) will deliver the plan in early

August to Gov. Brad Little and the Idaho State Police — involved because

the 2018 Farm Bill requires it and the state’s new law addresses transport

— for review and approval. Draft administrative rules and other supporting

documents will be included. The Idaho Legislature this year approved

industrial hemp production, to be overseen by ISDA. The Legislature in 2022

would review related administrative rules. First plantings could come in

the spring of 2022. The law allows production and transport of hemp

containing tetrahydrocannabinol up to the 2018 Farm Bill’s limit but does

not allow in-state possession or sale of THC-containing products. Read More (Capital Press)

Oregon launches hemp field inspections to crack down on

illicit cannabis operations. Agents from the Oregon Department of Agriculture (ODA)

will visit hemp fields across the state this summer to determine whether

the operations are legitimate, and Mason Walker, CEO of East Fork

Cultivars, said this is just one component of what he calls a “very large,

sweeping bill” that contains several regulatory changes for Oregon’s

cannabis and hemp farmers. Following Gov. Kate Brown’s signing of House

Bill 3000, the Oregon Liquor Control Commission (OLCC) held a special

meeting July 19 to approve temporary rules that allow the agency to work

with the ODA to begin field testing of the state’s registered hemp farms to

determine, based on the plants’ tetrahydrocannabinol (THC) content, whether

the farmers are growing legitimate hemp or illicit cannabis disguised as

hemp. Read More (Hemp Grower)

Montana hemp farmers awarded $65 million for broken contracts.

More than

two dozen Montana hemp farmers have been awarded $65 million in damages

from Canadian and the U.S. businesses and investors who promised to pay

them up to $700 per acre for hemp grown in 2018, then failed to pay. A jury

gave 25 farmers the second-highest civil judgment in Montana history,

including $56 million in punitive damages and another $9 million in

compensatory damages for causing “mental suffering, mental anguish, grief,

worry and disappointment or the like.” The hemp defendants ordered to pay

were: 1) USA Biofuels ($10 million), 2) Eureka 93 (LXLLF) ($10 million), 3) Vitality

Natural Health ($10 million), 4) Surety Land Development ($10 million), 5)

Kent Hoggan ($5 million), 6) Owen Kenney ($5 million), 7) Corey Shirley ($5

million), and 8) David Rendimonti ($1 million). Read More (Hemp Industry Daily)

Hemp goes 'hot' due to genetics, not environmental stress. A new Cornell

study—published July 28 in the journal Global Change

Biology-Bioenergy—finds no evidence that stress on hemp plants increases

THC concentrations or ratios of CBD to THC. Larry Smart, senior author of

the study and professor in the horticulture section of the School of

Integrative Plant Science in the College of Agriculture and Life Sciences

said: “With this research, growers should feel some comfort that stresses

do not seem to have a strong effect on changing the ratio of CBD to

THC." The study further proves that genetics, rather than environment,

determine the THC content and CBD to THC ratios in hemp. Read More (Phys.org)

CBD varieties don’t perform to COAs, Georgia researchers say. The hemp industry needs a

robust certification system that will give growers more confidence in their

genetics purchases, according to a study from the University of Georgia’s

Institute of Plant Breeding, Genetics and Genomics (IPBGG). The research

found that many of the 22 hemp varieties studied expressed THC and CBD

levels inconsistent with those stated on certificates of analysis (COAs).

Several had more THC, and less CBD, than levels indicated on those

certificates, which breeders and brokers use to market the genetics. The

researchers wrote: “Given the variability we found both among and within

accessions, some sort of standardization is needed so that producers can be

confident in the material they receive.” Read More (HempToday)

RETAIL

U.S.-based Cookies plans flagship cannabis store in Toronto

this year. Gage

Growth will work with Noya Cannabis to launch Cookies products exclusively

in Ontario, Canada, before expanding into other provinces, according to a

news release. In the announcement, Gage said it expects to open a flagship

retail store in Toronto by the end of this year. Gage signed an agreement

with Cookies last November to incorporate Cookies Retail Canada Corp, or

Cookies Canada. Under the deal, Gage received 80% of the new company and as

part of a license agreement with California-based Cookies signed in April

2019, Gage holds the rights to sell Cookies-branded products in Ontario,

Canada’s largest marijuana market, per a recent regulatory filing. Read More (Marijuana Business Daily)

Lemonnade dispensary, part of Cookies family, coming to

Denver. Denver

has been a ripe market for Cookies, and the California-based marijuana

company believes there's still plenty of juice to squeeze out here.

Lemonnade, a growing branch of the Cookies family tree, opened in the

Globeville neighborhood on Saturday, July 31, according to Cookies retail

operations vice president Crystal Millican. The new dispensary, located at

4500 Washington Street, will be the first Lemonnade store in Colorado. The

brand's licensing arm has been expanding into Colorado over the past year,

with both a Cookies store in Denver and a popular wholesale operation

launching in 2020, and another dispensary opening in June in Commerce City.

Read More (Westword)

Pittsburgh has acquired the first drive-through medical

marijuana pharmacy. Healing Research Center’s medical cannabis company has

expanded to Robinson Township, offering the first drive-through to the

Pittsburgh region Medical cannabis Clinic. The new drive-through dispenser,

owned by Verano Holdings includes four different drive-through stalls.

Healing Research Center Robinson Township is the second clinic by its name

in the state, with the first clinic in Chester County. Healing Research

Center partner Healing Center announced earlier this year that it had

purchased a 50% stake and growth facility in Agronomed Biologics, which

could expand four more locations in Pennsylvania. Read More (Pennsylvania News Today)

626 groups now qualify for upcoming lottery to win marijuana

store licenses in Illinois after applications are rescored. The number of applicants

qualified for the upcoming lottery for new marijuana store licenses in

Illinois jumped to 626 — with 97% qualifying for social equity bonuses — as

a result of a rescoring of their applications and lowering the qualifying

score, state officials announced. The number marks a huge increase from the

21 applicants who were given perfect scores to qualify for a license

lottery last year. Toi Hutchinson, the state’s senior adviser for cannabis

control said: “You wanted as many people as possible to at least have a

chance, so we’re very excited about making such a big jump.” Read More (Chicago Tribune)

Lantern expands on-demand recreational cannabis delivery to

Grand Rapids. Lantern launched on-demand recreational cannabis delivery in

Grand Rapids, becoming the first marketplace to offer delivery in

Michigan's second largest city. Lantern has been serving Michigan consumers

since October 2020 when it became the first platform to launch on-demand

delivery in Detroit. Recreational consumers in Grand Rapids can now order

their favorite products and brands directly from LanternNow.com and receive

their orders in 60 minutes or less. Lantern's latest expansion will

increase access to high-quality cannabis products, especially for consumers

who live in municipalities that have opted out of permitting recreational

provisioning centers. Read More (PR Newswire)

Apple platform offers another California marijuana company

app. After

changing its terms of service this summer, the Apple App Store has added at

least three California marijuana company apps, starting with Eaze, then The

Parent Co. and now Emjay. According to a news release, the app for

marijuana delivery service Emjay debuted on the Apple platform on July 29,

allowing cannabis customers to browse businesses’ MJ menus and place orders

for deliveries in Los Angeles, San Diego and San Francisco. CEO Chris

Vaughn said: “We’re thrilled to now be live on the App Store, be one of the

first native iOS applications for cannabis shopping and to be able to

provide a more convenient and seamless experience for our customers.” Read More (Marijuana Business Daily)

Arkansas to issue pot dispensaries last two licenses. State regulators decided

that they will issue the two remaining medical marijuana dispensary

licenses allowed under Arkansas' constitutional amendment, ultimately

raising the state's total number of dispensaries to 40. Amendment 98, the

constitutional change approved by voters in 2016, allows for up to 40

dispensaries spread across eight geographic zones in the state.

Thirty-eight have been issued, and in February members of the state Medical

Marijuana Commission declined to issue the remaining two on the basis that

the applications had expired before the meeting. Three of the members on

the commission in February have since been replaced by new appointees. Read More (Arkansas Democrat-Gazette)

Lottery for marijuana dispensary licenses delayed again in

Rhode Island. Businesses hoping to win licenses to operate six new medical

marijuana dispensaries in Rhode Island will be waiting longer. The lottery

to award the coveted licenses won’t happen in the first week of August as

expected, state regulators say, because the administrative appeal of one of

the rejected lottery applicants continues. Now a lottery won’t be scheduled

“until that appeal has run its course” Matthew Santacroce, chief of the

Office of Cannabis Regulation within the Department of Business Regulation,

said. How long that will be remains unclear, Santacroce said he may have a

better sense of the timing of events “in a couple weeks,” after more

meetings between lawyers for the DBR and the rejected applicant. Read More (The Providence Journal)

Government of the Northwest Territories wants online store. The Government of the

Northwest Territories (GNWT) is hoping to boost sales and safe access to

legal cannabis with an online presence, according to a request for

expressions of interest (RFEI) posted on its open contracts site. The GNWT

suggested that a business owner could sell and fulfill orders of products

purchased from the NTLCC out of their own warehouse or directly from the

NTLCC. It could be an existing retailer with an e-commerce platform, or a

business strictly dedicated to mail-order—the sky appears to be the limit,

as long as the website is restricted to people under 19 years old, won’t

sell to certain restricted postal codes, and respects 30-gram transaction

limits. Read More (Cannabis Retailer)

Proximity to marijuana retailers doesn’t influence young

people’s intention to use cannabis. Researchers with the RAND Corporation

and with the University of Southern California assessed the relationship

between the density of marijuana retailers and subjects’ intentions to use

either cannabis or tobacco in a cohort of young adults (ages 18 to 23)

living in Los Angeles county. They concluded: “Our results suggest that

young adults who lived in an area with a greater density of any type of

outlet were not significantly more likely to report stronger intentions to

use cannabis, e-cigarettes, or cannabis mixed with tobacco/nicotine in the

future.” Read More (NORML)

PRODUCTS

Curaleaf International launches second medical cannabis flower

product for the U.K. market. Curaleaf International (CURLF) announced the launch of

its second range of medical cannabis flower products for the U.K. market.

The new products are being manufactured in the U.K. and will be an

extension to Curaleaf International’s existing range of medical cannabis

flower and oil products. Antonio Costanzo, CEO, commented: “We are very

pleased to extend our range of medical cannabis products for the UK market.

As a market leader, Curaleaf International is focused on solving the key

patient and physician challenges relating to the price, accessibility, and

sustainability of medical cannabis products. Our vertically integrated

supply chain and GMP manufacturing facilities here in the UK allow us to

scale rapidly to meet growing patient demand.” Read More (Business Wire)

Organic produce shipper rolls out hemp baby greens mixes to

food service and retail companies. Field Fresh Farms is among the first

companies to go ahead with offering hemp baby greens as an ingredient in

leafy greens salad mixes for food service and retail companies. The

specialty, new-to-market product is certified organic through the U.S.

Department of Agriculture and will be sold under the Beach Road Organics

label. The company is developing product branding and retail packaging,

which will be rolled out later this year, but raw product is available for

food service. According to a company statement the hemp baby greens mix is

touted to be “packed with nutrients,” containing omegas 3, 6 and 9,

potassium and calcium, featuring “unique flavor profiles ranging from

citrusy to earthy.” Read More (Hemp Industry Daily)

Jushi Holdings Inc. collaborates with actor Colin Hanks. Jushi Holdings (JUSHF) announced that it

partnered with Colin Hanks to bring his handkerchief line, Hanks Kerchiefs,

to select BEYOND / HELLO retail stores. The collaboration expands on

Jushi’s vision for BEYOND / HELLO to work with new and like-minded partners

to build the company's brand into a modern retail leader that blends

exclusive and unique offerings with cultural experiences. The line of

kerchiefs created by the actor, producer and director is now available for

purchase at select BEYOND / HELLO dispensary locations, as well as online

nationwide at Shop Jushi. In addition, a portion of each Hanks Kerchiefs

sold will support several charities such as Homes for Our Troops, a nonprofit

organization that builds homes for veterans. Read More (GlobeNewswire)

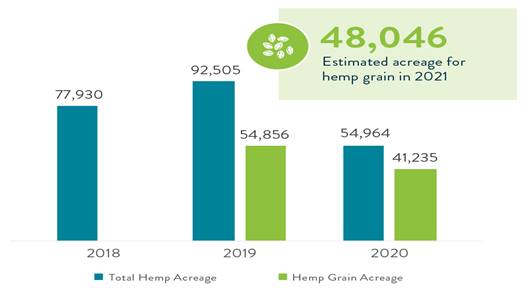

Competition rising over shelf space for hemp foods. Canada has long fed the

world’s demand for hemp foods. Over the past three years, Health Canada has

reported an average of 75,133 acres of industrial hemp production, with

48,045 (nearly 64%) of those dedicated to grain production. The president

of the Canadian Hemp Trade Association, Ted Haney, is confident of seeing a

15%-20% increase in Canadian hemp by the end of this year, a development

made more notable given a 37,540-acre decrease in Canadian cultivation from

2019 to 2020. As consumers increasingly notice hemp-based foods appearing

on store shelves, competition for the dollars of hemp hearts consumers has

been spurred. Read More (New Frontier Data)

|

Chart 16: Canadian Hemp Acreage

|

|

|

Source: Intro-act, New Frontier Data

Marijuana vape manufacturers, retailers in limbo over

long-delayed mail ban. Months of delay on the U.S. ban on shipping vape components

has marijuana and hemp operators wondering if they should prepare for

seismic shocks to their business models or proceed as usual and hope the

ban never takes effect. The ban was supposed to kick in last spring, the

result of a 2020 law that prohibits the U.S. Postal Service from shipping

vaping products. The ban included products without nicotine and could

eliminate direct-to-consumer vape shipping. But in April, when the USPS

said it planned to publish details on enforcing the ban, the agency said it

needed more time to review public comments. Read More (Marijuana Business Daily)

Exploring Twitter data on cannabis edibles. Scientific, economic, and

social research on cannabis is occurring at a pace faster than at any other

time in history. As technology advances, so do the ways in which

researchers gather information. Twitter is relatively new to modern

society, and it has become a valuable source of information on cannabis

use, notably for a study on edibles. In 2016, researchers published a study

in which they analyzed the content of Twitter messages relating to cannabis

edibles. Their principal objective was to analyze Twitter users’ perception

of edibles. In general, researchers found that the sampled Twitter users’

experiences with edibles were positive overall, with 56.8% of them relating

a positive attitude compared to only 13.2% being negative. Read More (Extraction Magazine)

Cannabis pre-roll sales soar as Canadians share joints less

during pandemic. Canadian cannabis users are doing a lot less puff, puff, pass

during the COVID-19 pandemic, as people try to minimize their distance and

contact with one another. Research commissioned by the Smiths Falls, Ont.

company revealed that the pre-roll joint category grew by 48 percent across

the entire market between January and May 2021. A report from the Ontario

Cannabis Store shows almost $97 million of pre-rolls were sold between April

2020 and March 2021, up from $42.6 million between April 2019 and March

2020. Part of that sales increase is attributable to a significant rise in

the number of cannabis stores, but Canopy Growth (CGC) says Canadians who feel

that traditional 0.5 gram joints are too big for them to enjoy in one

sitting, and who worry about passing germs along with joints, are factors

as well. Read More (msn)

The future of cannabis and the beverage industry: an interview

with Keith Villa. When asked about what effect could legalization have on the

brewing industry? Keith Villa said: “It’s a mixed bag. Right now, you can’t

mix cannabis and alcohol on a federal or state level. I don't see that

changing anytime soon, even though people think you could get a really good

buzz if you combine them. There's a cautionary tale that people should pay

attention to from the early part of this century when Four Loco was the

rage. They mixed high levels of caffeine and alcohol in a drink. It led to

many people getting quite sick, and the FDA put out rules banning that. So,

we should not rush into that until we know more, but there will be a boom

of non-alcoholic beers with THC in them should the laws change. You can

make those now in states where recreational cannabis is allowed.” Read More (Forbes)

How cannabis vaporizers are continuing to evolve. There’s controversy out

there about who should be credited as the originator of modern-day herb

vaporization, but research suggests the first ever e-cig was created in

1927 by Joseph Robinson. After that, the first “smokeless non-tobacco

cigarette,” was created by Herbert Gilbert in 1963. And the first portable

herb vaporizer, called the “Shake and Vape,” was created in 1993 by Eagle

Bill Amato. Shortly after that, Storz and Bickel came out with the famous

tabletop Volcano vaporizer in 2000. In 2003, Chinese researcher Hon Lik