Q&A OF THE MONTH: BENSON HILL ON MERGER WITH STAR PEAK CORP. II (NYSE: STPC)

1. What is Benson Hill’s core business and technology?

Benson Hill is a food technology company that uses artificial intelligence (AI), data and a variety of breeding techniques to create innovative food and ingredient products. Starting with the seed and through an integrated business model, we work with partners and growers to bring products to market that meet consumer needs for food that is more nutrient dense, more sustainable, more affordable and better tasting.

Our proprietary CropOS® technology platform uses predictive analytics to simulate tens of millions of genetic outcomes for plants, referencing an ever-expanding and world-class data library. The technology has the potential to shave years off the traditional crop breeding process, shortening the time to market, and decreasing development costs for new food and ingredient products. Benson Hill’s approach is tailored to meet consumer demand and link the interests of both growers and consumers, which has been a historical divide in the food system.

2. Tell our readers about Benson Hill’s transaction and partnership with Star Peak Corp II.

In May, we announced that Benson Hill is becoming a publicly listed company through a merger with Star Peak Corp II (NYSE: STPC), a SPAC sponsored by affiliates of Magnetar Capital and Triangle Peak Partners.

In addition to the capital we’ll raise in this transaction, the combination provides us a partner in Star Peak Corp II who shares our commitment to sustainability and confidence in our promising future, while bringing a rich history of partnering with high-quality companies across the sustainability, energy infrastructure, renewables and technology landscape. The Star Peak leadership team were behind bringing Stem, Inc. public through Star Peak Energy Transition Corp., creating the first pure-play smart energy storage company to go public in the U.S. and resulting in more than $600 million of gross cash proceeds to Stem.

Through this transaction, we expect to receive gross proceeds of up to $625 million, assuming no redemptions, to fund our strategic plan. This means more to invest in our proprietary CropOS® technology platform, strengthen partner development efforts, support product commercialization and expand into new agri-food markets.

Once the transaction is complete, expected in Q3 2021, we will trade on the NYSE as BHIL with a strong balance sheet that will allow us to accelerate our growth.

3. How does Benson Hill differentiate itself?

With a broad intellectual property portfolio supported by CropOS® data and software, and a combination of technology and supply chain innovation, we are competitively positioned to drive long-term value. Our competitive advantage includes:

· A proprietary and massive data library that is expected to double in size each year.

· World class data on high protein soybean germplasm

· Machine learning benefits from insights others don’t have

· Speed of implementation of new crop varieties through technology

We have a strong pipeline of proprietary food and feed products, made better from the beginning by our innovative seeds. We leverage seed innovation with integrated supply chains and best practices in the field to enable greater sustainability for ingredient and food companies and retailers, end-to-end traceability for consumers, and additional revenue opportunities for farmers.

4. What is Benson Hill’s market opportunity?

Near-term, our Ultra-High Protein soybean and planned yellow pea varieties are set to serve the plant-based meat market, forecasted to reach approximately $140 billion in retail value over the course of this decade, according to industry sources.

Our Fresh business segment is positioned over the long-term for technological capabilities to serve a forecasted approximately $1.1 trillion total produce market by 2025.

As we continue to grow, our proprietary CropOS® technology platform will enable Benson Hill to serve new and growing food markets across the approximately $5 trillion agri-food industry.

5. What is your path to profitability? When can we expect you to get there? Are you focused more on growth or profitability? What is your growth strategy?

We have confidence in the financial plan shown in the presentation on our website’s Investor Relations page. The plan was scrutinized by a group of outside experts that validated our technology and product development. The plan is an execution play focused on driving broad adoption of our proprietary products.

With products already in the market, Benson Hill’s net revenue was $102 million in 2020 and we project it to grow to approximately $560 million in 2025 and approximately $1.5bn by 2027, representing a ~46% compound annual growth rate from 2020 to 2027. We expect to achieve this growth primarily by expanding our existing pipeline of proprietary seed, food and feed ingredients.

6. What will your pipeline look like in 10 years? How diverse do you expect it to be in terms of crop variety?

We believe our product pipeline will continue to increase in size and scope as our Fresh business matures and we execute co-development projects with end customers. In just the last several months, we have executed memorandums of understanding with leading Agri-Food companies and expect this momentum to continue to drive our pipeline expansion. Consumer, Food, and Feed companies are the ultimate drivers of our product direction, and we are encouraged that they are seeking us out as product development partners.

Remember, agriculture is a long lead process. We believe our proprietary CropOS® technology platform will allow us to operate at the speed of biology, better than anyone else. We plan to continue to improve our capabilities to efficiently bring to market high-quality innovative seed and products that meet the needs of consumers.

We fundamentally believe in leveraging the vast, untapped natural genetic diversity within a variety of plants to serve new and growing food markets across the approximately $5 trillion agri-food industry.

7. Why is Benson Hill a positive ESG story?

As a pure-play ESG, our products have the potential to contribute to a more sustainable and nutritious food system, through reduced environmental impact and improving social outcomes, for example, increasing the protein content of soybeans. Our products have an inherent positive impact on society versus incumbents, who instead are working to reduce the negative impacts of their current operations.

Through our operations, Benson Hill seeks to create environmental benefits at all stages of product development through on-farm management practices like regenerative ag, reduced processing steps that eliminate energy and fuel use, and opportunities to scale consumer products like plant-based meats that offset industries that are more GHG emission intensive.

By combining advancements in biology and our inclusive agri-business approach, the very purpose of our business creates positive impact for society, which demonstrates responsible global citizenship clearly aligning with frameworks such as the Unite Nations Sustainable Development Goals.

DEAL IN FOCUS: KIN INSURANCE – OMNICHANNEL ACQUISITION CORP. (OCA)

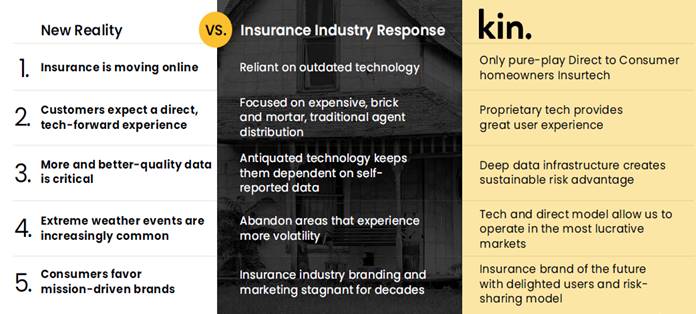

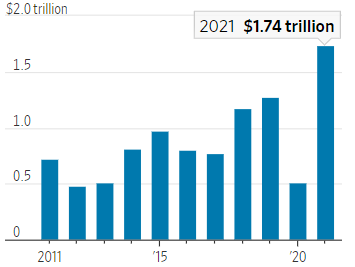

Kin Insurance, Inc. is a fully licensed home insurance technology company that provides affordable coverage to homeowners in catastrophe-prone regions. Every day brings catastrophic headlines about once inconceivable weather events. Climate change felt anywhere will eventually be felt everywhere, and many legacy insurance companies have been unable to navigate this volatility, often leaving at-risk regions, dropping policyholders, or both. This has created an opportunity for Kin, the only pure-play DTC homeowners insurtech in the U.S., which has created a consumer-friendly solution at the intersection of climate change and technology. By leveraging proprietary technology, Kin delivers fully digital homeowners’ insurance with an elegant user experience, accurate pricing, and fast, high-quality claims service. Kin offers homeowners, landlord, condo, and mobile home insurance through the Kin Interinsurance Network (KIN), a reciprocal exchange owned by its customers who share in the underwriting profit. Because of its efficient technology and direct-to-consumer model, Kin provides affordable pricing and peer leading customer reviews without compromising coverage. Kin is the only pure-play direct-to-consumer digital insurer focused on the complex and growing $100+ billion homeowners insurance market and it continues to grow as severe weather events occur more frequently and in more parts of the country.

|

Chart 1: Kin Is Built for the Digital Era Even as Competitors Are Stuck in the Past |

|

|

Source: Intro-act, Kin Insurance Investor Presentation

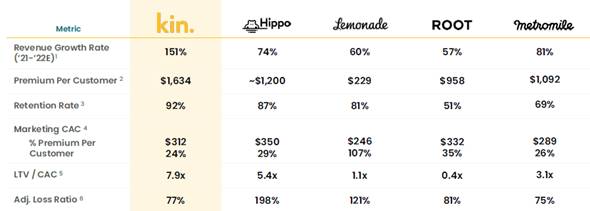

Kin is growing rapidly with enviable unit economics, powered by a proprietary digital platform which creates significant tech and data advantages. Kin’s proprietary technology enables customers to insure their homes in minutes online, bringing convenience to a historically manual process. Future customer needs like making a policy change or filing a claim are similarly automated and convenient. Behind the scenes, Kin utilizes thousands of data points about each property to provide accurate pricing and produce better underwriting results. Kin’s 100% direct to consumer model makes it very good at optimizing targeted marketing and even better at client conversion. Its high lifetime value and fast payback result in very attractive unit economics with LTV/CAC of nearly 8x and it also have a high average annual premium of over $1,600.

Kin’s direct to consumer model is a fundamentally better business model than competitors for several reasons: 1) It eliminates an unnecessary barrier between the carrier and the consumer, giving total control over the entire process, 2) It is what the customer wants as customers prefer a direct, online, simplified, and automated experience of superior quality, and 3) The unit economics are much better, primarily because Kin does not use agents. The company operates a reciprocal exchange, which helps it to limit its risk and thus providing a recurring, high-quality revenue. Kin’s sophisticated underwriting and easy-to-use online interface allow customers to buy affordable home insurance within minutes. The customer satisfaction is evident through 92% customer retention rate, net promoter score of 85, and a 96% trust-pilot 5-star rating. This customer stickiness leads to significant stable recurring revenue and consistently improving unit economics.

|

Chart 2: Kin Is an Insurtech Leader in Unit Economics |

|

|

Source: Intro-act, Kin Insurance Investor Presentation

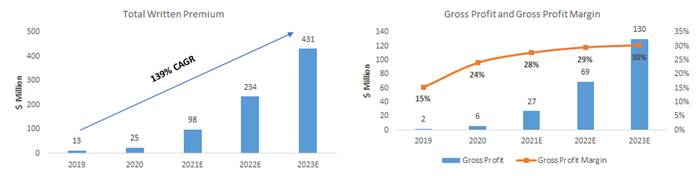

Fundamentals are strong, and Kin expects to generate over $400 million of premium by 2023 as it has multiple levers – geographic expansion, new products, and new channels – to accelerate growth beyond the current rapid pace. In the first quarter of 2021, Kin generated $17 million in written premium, more than doubling last year’s first quarter total. This recent upward trajectory puts Kin well on pace to generate just under $100 million in total written premiums for the full year 2021. Currently, Kin operates three states – California, Florida, and Louisiana. However, it plans to expand into a handful of other states by mid-2022, which will give it access to almost 50% of the $100+ billion homeowners insurance market. And by 2023, that figure will reach 87%. Kin’s deal with Omnichannel Acquisition Corp. (OCA) will allow it to further increase brand awareness across new marketing channels to drive stronger conversion. The company’s priority is to build top-of-the-funnel awareness so that it can continue to disintermediate lead aggregators and grab significant demand. Kin also has a massive cross-sell opportunity given that homeowners are the best customers for insurance and non-insurance products. Kin appeals to customers of all ages, with an average customer age of 57, unusual for direct-to-consumer brands, which typically service younger customers. It also plans to add other insurance products in time, including auto and life, as well as non-insurance products such as home services, solar and home finance, and additional home risk segments such as flood. By successfully implementing its growth strategy, Kin plans to achieve over $400 million of total written premiums by end of 2023, corresponding to a 5-year CAGR of 139%, allowing the company to garner substantial market share and drive profitable rapid growth in an extremely inefficient industry.

|

Chart 3: Kin Is on the Cusp of Rapid and Profitable Growth Through 2023 |

|

|

Source: Intro-act, Kin Insurance Investor Presentation

In July 2021, Kin Insurance announced a business combination with Omnichannel Acquisition Corp. (NYSE: OCA) that values the company at $1.03 billion (pro forma EV). The transaction is supported by a fully committed $80 million PIPE at $10 per share of Class A common stock of Omnichannel, led by HSCM Bermuda and Senator Investment Group. The transaction is expected to provide Kin with approximately $242 million of cash at closing, which is in addition to the $80 million raised in the recent Series C financing. The funding will be used to support Kin’s continued growth in existing markets, expansion into new markets, new marketing channels, and product portfolio expansions including new insurance and home-related products. Kin’s existing stockholders will be rolling 100% of their equity into the combined company and are expected to own approximately 74% of the combined company. The company’s pro forma enterprise value is ~$1.03 billion, representing 15.0x 2022 estimated adjusted gross profit and 4.4x 2022 estimated premium. The transaction is expected to close in 2H21 and the combined entity is expected to be listed on the NYSE under the ticker “KI”.

|

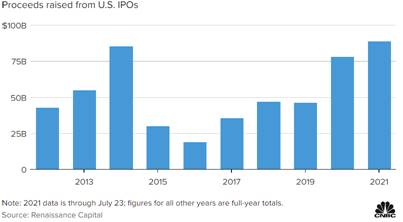

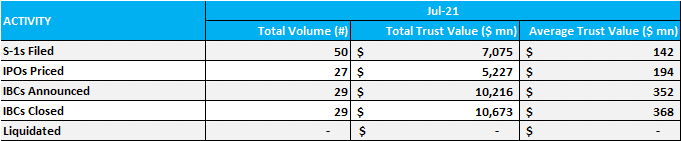

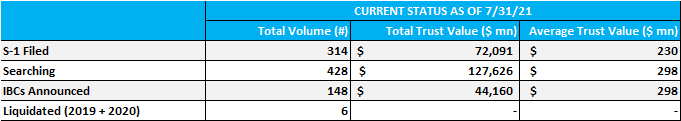

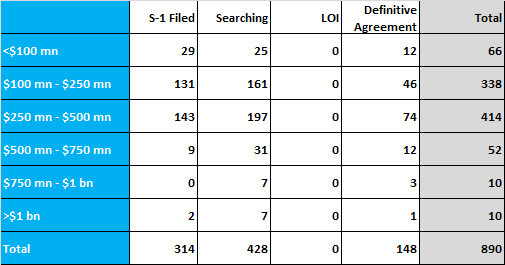

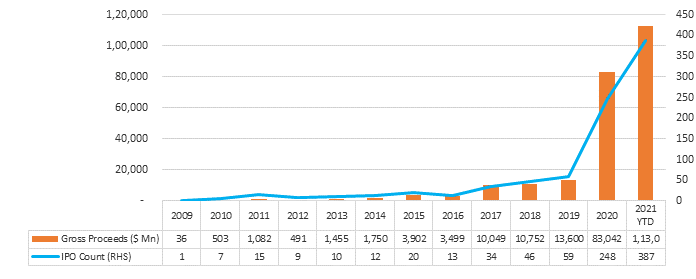

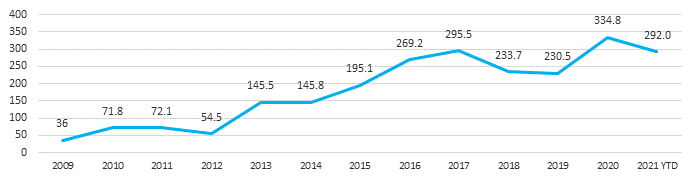

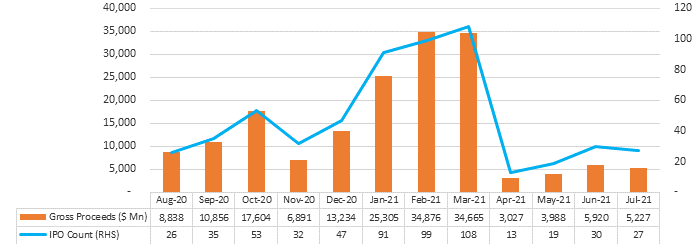

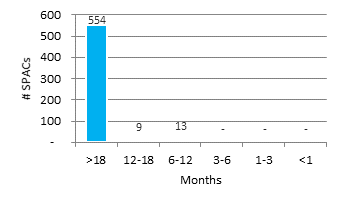

The size of the average SPAC is rising. Here’s why that’s important for investors. The SPAC spigot is slowing, but that may not spell doomsday for the space. Special purpose acquisition company issuances amounted to roughly 50% of initial public offerings in June and July, down from 75% in the first quarter. They briefly dipped to 20% of IPO issuances in April, spooking those behind the trade’s surge in popularity. But average SPAC deal size is climbing, sparking hope for SPAC-based ETF issuer Mark Yusko that these new investment vehicles still have legs. “The size of an IPO, whether it’s a traditional IPO or a SPAC, is absolutely a proxy for quality. And the size of the average SPAC has been rising. The size of the average IPO has been falling,” the CEO and chief investment officer of Morgan Creek Capital Management told CNBC’s “ETF Edge” Read More (CNBC)

IPO and SPAC surge expected to slow, study says. Investors continue to feel enthusiastic about the IPO and special purpose acquisition company (SPAC) markets, though many expect the number of new entrants to the public markets to tail off by the end of the year, according to a new survey from Edelman. During 2020, despite the volatility caused by the Covid-19 pandemic, the global IPO market and SPAC IPOs both hit historic highs. Almost nine in 10 investors surveyed by Edelman expect to invest in at least one IPO and SPAC listing this year. But the same number of investors anticipate that the pipeline of companies coming to the public markets will dry up: 90 percent of investors expect the IPO market to slow down by the end of the year, while 92 percent think there will be fewer SPAC listings by December. Read More (Corporate Secretary)

Benchmark’s Bill Gurley says SPACs are ‘remarkably cheap compared to mispriced IPOs’. Bill Gurley said that Nextdoor’s decision to go public through a SPAC instead of an IPO was largely due to a pricing advantage. He said the company was running a dual-track process and decided it could get “better economics by going the SPAC route.” Gurley has been among the most vocal supporters of direct listings, another IPO alternative in which companies go public without selling shares at a steep discount to new investors. He said the average IPO in 2020 came with a 57% cost of capital. Read More (CNBC)

SPAC bosses turn to clubby deals to seal IPOs in chilly market. Fierce competition amid freezing markets is forcing some blank-check companies to pull all stops to push deals to the finish line. Many new special purpose acquisition companies just before their market debut change their filings to show that they have already pledged to a group of investors. With more than 420 SPACs seeking to take a private company public and another 295 pending initial public offerings, having a friendly investor on hand can make it easier to strike a deal. In extreme cases, SPAC has lined up buyers for more than half the IPO. Read More (Bloomberg Quint)

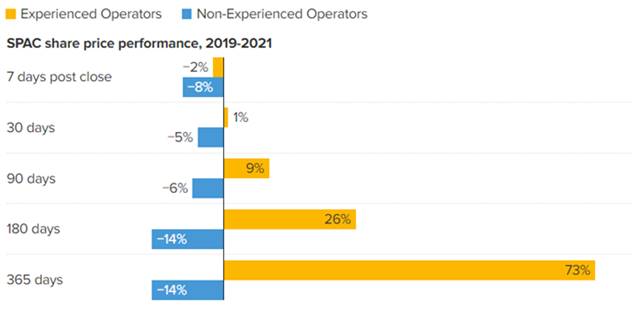

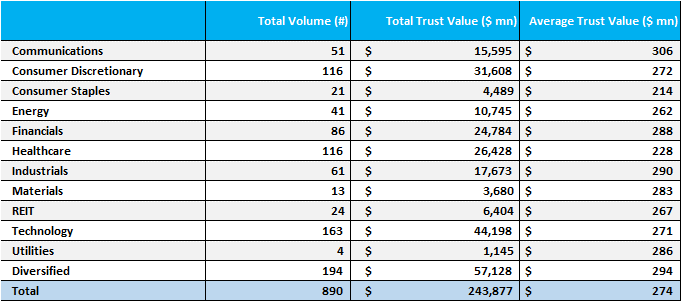

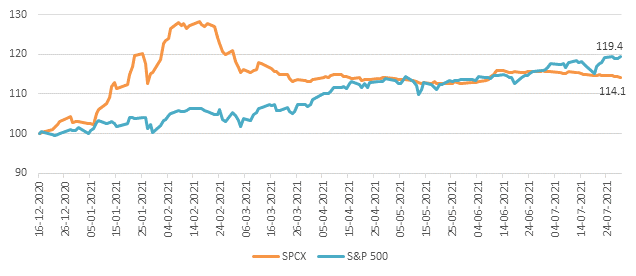

For SPACs, one characteristic seems to determine the investing winners from losers. For SPAC investors wanting to pick winners in the cooling market, one characteristic of blank-check deals has led to steady outperformance. The biggest make-or-break factor of a SPAC’s stock performance post-merger was the sponsor’s related experience to the acquired company, or lack thereof, according to Wolfe Research. The firm found that SPACs led by someone with experience in the acquired company’s industry generally recorded big returns. Shares of deals with seasoned leaders tend to outperform those without by a wide margin during one-month, three-month, six-month, and one-year periods after the mergers close, according to Wolfe Research. One year out, SPACs with experienced operators averaged a 73% rally, whereas those lacking an industry veteran suffered a 14% loss on average, the firm said. Read More (CNBC)

|

Chart 6: SPACs With an Experienced Operator Win |

|

|

Source: Intro-act, CNBC, Wolfe Research

SPAC deals spark boom in fairness opinions. As the global economy recovers post-pandemic and the number of capital market transactions increases, the first part of 2021 has seen an unprecedented 468 fairness opinions on $682 billion worth of deals, according to Refinitiv. One trend driving the recent rise in these advisories is the SPAC wave. In light of the unusual structure of the deals, the volatility of the SPAC market and the visionary nature of many tech targets, most of these transactions involve a fairness opinion. Read More (Global Finance)

Behind the hype: Are SPACs a good route to exit? The popularity of special purpose acquisition companies, or SPACs, has exploded in the last year. While they have been around for many years, it is only in the last couple that their use has accelerated. Just because there’s a lot of hype around SPACs now doesn’t mean they’re necessarily the best way to exit right now. The boom in popularity could have a detrimental effect on the market, as we could see a lot of investment vehicles chasing a limited number of attractive businesses, driving prices up. If a company’s acquisition price becomes too inflated, the return to value for the SPAC becomes more drawn out. Read More (Crunchbase)

How to be a favorable SPAC acquisition: Five key areas of consideration. Becoming a public company through an acquisition by a special purpose acquisition company (SPAC) has increased in popularity over the last two years as an alternative to the traditional initial public offering (IPO) route. With the potential for immediate turnaround considered, target companies must consider their readiness to become a public company and effectively operate as such prior to the completion of the merger with a SPAC. Five key areas to consider are: 1) Internal controls & Sarbanes-Oxley (SOX) compliance, 2) Accounting and tax considerations, 3) Financial statement preparation, 4) Compliance with required filings and registrations, and 5) Digital solutions. Read More (Dallas Innovates)

The uneasy partnership between private equity and SPACs. The spectacle of the SPAC, or “special-purpose acquisition company”, has preoccupied bankers on Wall Street over the past year. This is in part because the vehicles, which list a shell company on stock markets and raise a pot of capital before hunting for a private company to merge with, are often touted by their backers as an alternative to an initial public offering (IPO). Big banks make meaty fees from their IPO businesses. For some, the fact that SPACs have muscled in is an unwelcome development. As voracious buyers of private firms, though, SPACs are attracting as much attention among the private-equity (PE) barons on New York’s Park Avenue as on Wall Street. Read More (The Economist)

Ultra-rich are now turning to crypto after driving the SPAC boom. Firms that manage the wealth and personal affairs of rich people are increasingly looking to make bets on crypto. That’s according to Goldman Sachs Group Inc, which found that nearly half the family offices it does business with want to add digital currencies to their stable of investments. The bank reported that 15% of respondents in a recent survey — which included responses from more than 150 family offices worldwide — are already invested in cryptocurrencies. Some family offices have long been investors in private equity and real estate but have recently been one of the biggest drivers of the boom in special purpose acquisition companies, or SPACs. Read More (The Edge Markets)

Palantir has quietly become a major SPAC investor. Big data analytics company Palantir Technologies has quietly become an aggressive investor in companies going public via SPACs, or special purpose acquisition companies. Palantir has participated in at least eight SPAC-related PIPE transactions, investing well over $100 million, using the deals to win contracts from emerging companies. Shyam Sankar, Palantir’s chief operating officer, said a perception exists that Palantir’s software is only suitable for huge companies and government agencies. “We don’t think that to be true,” he said. “With SPACs, we see a historic opportunity to invest in our customers.” Read More (Barron’s)

The not-so-happy story of the world’s biggest SPAC. Bill Ackman isn’t known for always being right. The impressive portion of his record allowed Ackman, the billionaire founder and CEO of hedge fund Pershing Square Capital Management, to raise $4 billion for his own SPAC a year ago. Ackman’s project, known as Pershing Square Tontine Holdings, is the largest SPAC ever created. The promise of Tontine was that Ackman would find an appealing investment opportunity in a private company and that — through the magic of SPAC-ing — shares in PSTH would become shares in that other company. Last month, instead of a merger, Ackman announced that the SPAC would acquire a 10% stake in Universal Music Group when it finalizes plans to spin out of Vivendi, the French media company. Then Ackman announced that actually none of that would happen. Read More (Intelligencer)

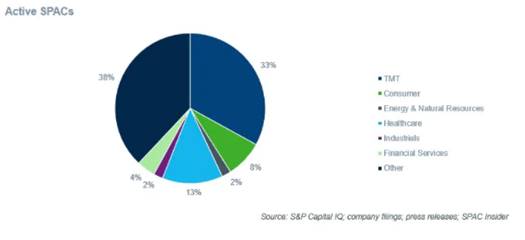

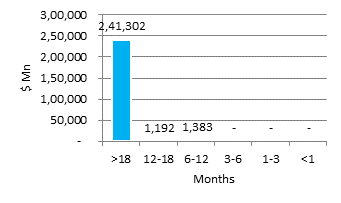

Decoding the SPAC opportunity. The first quarter of 2021 saw a continued expansion in the number of SPACs formed. In a statement on April 8, 2021, the U.S. Securities and Exchange Commission (SEC) said: “Over the past six months, the U.S. securities markets have seen an unprecedented surge in the use and popularity of special purpose acquisition companies.” While many SPACs do not advertise a specific industry or focus on an intended target, technology, media, and telecommunications (TMT) remain the most targeted industry among active SPACs, with more than 33% of total active SPACs, followed by the healthcare industry. Given the current market valuations, potential capital gains tax changes, and the involvement of more traditional financial sponsors and financial firms, it is reasonable to believe there will be plenty of high-quality, private equity-backed companies and corporate carve-outs to support SPAC momentum for the foreseeable future. Read More (CNBC TV18)

|

Chart 7: Key De-SPAC Transactions during 2020-2021 |

|

|

Source: Intro-act, CNBC TV18

Pervasive SPAC accounting error prompts mass restatements. An accounting error that came to light in the spring forced hundreds of blank-check companies to flag financial statement mistakes at levels not seen in more than a decade. More than 340 special purpose acquisition companies in the past three months issued corrections, or restatements, of prior financial statements—quadruple the number of restatements issued by all companies in 2020, according to research firm Audit Analytics. An additional 231 blank-check companies had to make smaller corrections via revision, according to the firm. All told, about 86% of SPACs got stymied by the same complex accounting rule, the firm’s data shows. Read More (Bloomberg Law)

SPAC restatements proliferate in wake of SEC warning. A warning from the Securities and Exchange Commission about accounting for the warrants used by special purpose acquisition companies has prompted hundreds of them to issue financial restatements. The SEC issued a statement in April saying that many of the SPACs had been accounting for warrants improperly as equity when they should have been accounting for them as liabilities. The warrants are an inducement to attract investors by offering them the right to acquire shares at a certain price. The SEC warning has prompted more than 340 companies to restate their financials, according to Audit Analytics and Bloomberg Law, while another 231 companies needed to make slight revisions. Over 540 companies, or three-fourths of the SPACs, needed to make restatements, according to Audit Analytics and The Wall Street Journal. Read More (Accounting Today)

FINRA announces impending Special Purpose Acquisition Company sweep. On July 22, Financial Industry Regulatory Authority (FINRA) CEO Robert Cook announced the self-regulatory organization’s plan to conduct a series of targeted reviews into special purpose acquisition companies or SPACs. Speaking at the Securities Industry and Financial Markets Association’s virtual summit, Cook said FINRA is in the “early stages of preparing some targeted sweeps” to address the latest trends affecting financial markets, such as SPACs, “finfluencers” (social media influencers giving financial advice), and options account openings by unsophisticated investors. Cook noted that FINRA continues to be “interested in the SPAC space and the conflicts of interest that might be there.” Read More (Sidley)

U.S. SEC focuses on bank fee conflicts as it steps-up SPAC inquiry. The U.S. securities regulator has ramped-up its inquiry on Wall Street’s blank check acquisition frenzy, homing in on potential conflicts of interest created when banks act as underwriters and advisers on the same deal. The Securities and Exchange Commission is exploring whether certain fee structures may incentivize underwriters on special purpose acquisition company, or SPAC, listings to secure unsuitable deals when also advising on the later stage merger, potentially putting investors at risk. Read Report (Reuters)

SEC says a SPAC misled investors about its space deal. A deliberate merger involving an upstart area transportation company might not get off the bottom after securities regulators introduced one of many first main enforcement actions focusing on a cash-rich clean test company. The Securities and Exchange Commission stated that it had reached a civil settlement with a number of events concerned within the deliberate merger of Momentus, a company that stated it had developed a distinctive propulsion know-how, and Stable Road Acquisition, a particular goal acquisition company. Investors had been misled into believing the propulsion system had been efficiently examined in area, when the take a look at had failed, regulators stated. Read More (News Chant)

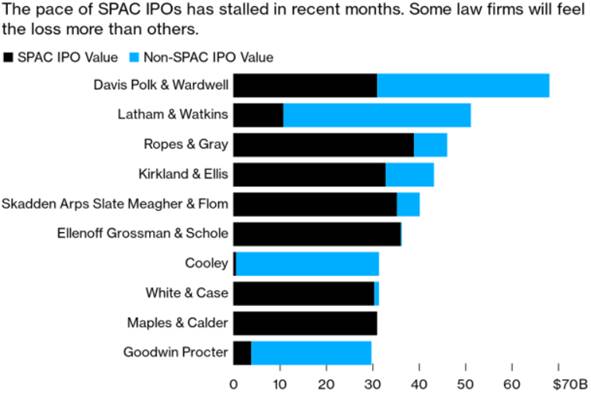

The SPAC explosion dimmed but law firms are still cashing checks. Special purpose acquisition companies are no longer raising record levels of new cash, but that’s OK with Joel Rubinstein. The White & Case partner is optimistic the summer vacations many capital markets lawyers missed out on a year ago might return this August. “The cadence has slowed in these transactions, which I think is healthy,” Rubinstein told Bloomberg Law. “The frenzy was really unsustainable.” While the wave of SPAC IPOs seems to have gone out as fast as it came, some Big Law capital markets attorneys have moved on to the more lucrative, second step in the SPAC process—advising blank check companies in their go-public acquisitions, known as “de-SPACs.” Read More (Bloomberg Law)

|

Chart 8: SPAC-ing Out |

|

|

Source: Intro-act, Bloomberg LP

SPAC lawsuits double as other shareholder class actions plunge. Class-action lawsuits against blank-check companies surged in the first half of the year, even as the number of overall shareholder cases alleging securities law violations plunged, Bloomberg writes, citing a new report. Federal suits against SPACs have continued to pile up, with 14 such filings in the first half of 2021, compared to seven in all of 2020 and six in 2019, according to an analysis by Cornerstone Research and Stanford Law School’s Securities Class Action Clearinghouse. More than half of the 14 suits alleged that targets of the firms defrauded investors by overstating the viability of their products, according to the report. Read More (Bloomberg)

CFOs called key to setting comparable in SPAC warrant valuations. Finance chiefs in special purpose acquisition company (SPAC) mergers can play a role in the valuation accuracy of the warrants attached to their companies' shares, a valuation specialist says. Although warrant valuations involve modelling that tends to be too complex for many internal finance teams, CFOs can help ensure valuations provide an accurate representation of volatility risk by taking the lead on selecting the comparable used in the modelling, says Louisa Galbo, managing director of complex securities at Duff & Phelps, a Kroll company. Read More (CFO Dive)

SPACs: Advisers face their own reckoning in regulatory crackdown. Dozens of space-age companies that are good at hype and lack income are listing their shares through SPACs. The SEC’s actions are to provide SPAC sponsors (often well-known investors and Wall Street banks) with appropriate due diligence for targeted companies before making a starry sky promise to investors. Apply pressure correctly. One group that deserves scrutiny is a white shoe investment bank and a law firm. These respected groups are willing to chase after reverse merger enthusiasts. They can also offer something unjust Fine veneer In a SPAC deal, as Momentus’s rebuke reveals. Read More (California News Times)

Trump friend Tom Barrack ordered released on $250 million bond; his SPAC pulls SEC registration, IPO plan. A federal judge in Los Angeles ordered the release on a $250 million bond of Thomas Barrack, a close friend ex-President Donald Trump. Barrack is accused with two others of secretly trying to influence Trump’s foreign policy at the direction of senior UAE officials. A company backed by Barrack, Falcon Acquisition, told the Securities and Exchange Commission it is withdrawing its company registration statement. Falcon Acquisition said it pulled the registration “because the company has elected to abandon” planned transactions. Read More (CNBC)

Trouble hits de-SPACed Lordstown Motors from all angles. The Justice Department is probing embattled electric truck startup Lordstown Motors, The Wall Street Journal reports, coming on the heels of an SEC investigation, and the abrupt resignation last month of two key executives. Lordstown merged last year with SPAC DiamondPeak Holdings in a deal valued at $1.6 billion. The SEC first requested information from Lordstown Motors in February and has issued subpoenas regarding Lordstown Motors’ move last year to become a public company and its representations about preorders, according to company filings. Lordstown Motors has said it is cooperating with the SEC’s investigation. Read More (DealFlow’s SPAC News)

Spotify Rival’s Nasdaq listing may herald Mideast SPAC boom. Spotify Technology rival Anghami’s listing via a merger with a blank-check company has triggered a flurry of interest from Middle Eastern firms exploring similar deals in a region where they are a rarity. Anghami had announced plans to merge with Vistas Media Acquisition in March. Since then, Vistas says it has got “an overwhelming response” from venture capital, private equity firms and entrepreneurs to explore opportunities. “We strongly believe there are many similar hidden gems, like Anghami, in the region that can be considered not only by our future SPACs but even other SPAC teams for a successful business combination,” Saurabh Gupta, Vistas co-founder and board member, said in an interview. Read More (DealFlow’s SPAC News)

Fitness IPO gives SPACs a work over. Mark Wahlberg’s fitness company has shown that the projections bandied around in SPAC mergers can sometimes prove conservative. F45 Training, which puts workout-goers through 45-minute sessions, is planning an initial public offering roughly a year after abandoning a merger with a special purpose acquisition company. The delay has paid off: F45 is gunning for a value of $1.5 billion, 80% more than in the SPAC deal. F45’s revenue fell by 11% in 2020, to $82.3 million. That's about half what it had forecast before Covid-19. But it's a solid outcome considering competition from stay-at-home workouts like Peloton Interactive and beats the scaled-back $60 million forecast F45 put out after the pandemic hit. In the last year its studios, nearly all franchises, also increased by a fifth, more than anticipated. The market is also hotter now. In the year since F45 agreed to be bought by Crescent Acquisition for $845 million, gym operator Planet Fitness’s enterprise value-to-sales multiple has also doubled. Read More (SPAC Track)

TerraNova Capital announces launch of SPAC backstop and deSPAC finance platform. TerraNova Capital Structured Finance, the credit advisory and special purpose finance division of TerraNova Capital Equities, Inc. announced the launch of their SPAC Backstop and deSPAC finance platform. The TerraNova finance platform will help SPACs identify structured finance solutions in conjunction or in place of PIPE financing and redemption shortfalls. The platform is designed to create low friction solutions for SPAC Sponsors, as well as underwriters. "With over 200 SPACs seeking to execute completion of their target deSPAC and mergers, many SPACs are concerned about the ongoing constraints in the PIPE Market as well as redemptions," stated Todd Coffin, Head of Structured Finance. Read More (Yahoo! Finance)

PE-backed SPACs take center stage in crowded market. Private equity-backed special purpose acquisition companies could be the early beneficiaries from a market-wide rethink of the listing-by-purchase deal structure. In a market awash with SPACs, buyers who can offer deep sector expertise can differentiate themselves from general asset managers whose rush to deploy funds could result in high purchase prices. Read More (The Middle Market)

Branson’s flight validates the space SPACs that Virgin started. For years, executives at Virgin Galactic have said that a key step along the way to offering passenger flights into space was to send the company’s founder, 70-year-old Richard Branson, on his own test flight. Virgin Galactic has been a pioneer for the space industry in other ways, too. In 2019 the company went public by merging with a special purpose acquisition company, or SPAC. It was an early use of a then-obscure financial tool that has since become a popular way for risky companies to access public-market investors before they’d realistically be able to pull off a traditional initial public offering. According to their backers, the enthusiasm for SPACs is providing resources to early-stage companies pushing innovation in a potentially transformative field. “When you’re a startup, if you can’t have access to capital, you crash and burn,” says Craig McCaw, whose SPAC, Holicity Inc., recently merged with satellite-launch-services company Astra. Read More (Bloomberg)

SPACs forced to fund deals with more expensive financing. Blank-check companies are turning to expensive sources of financing to push their deals over the line in a fresh sign of stress in what had been one of the hottest corners of Wall Street, The Financial Times reports. Several companies that recently announced plans to go public by merging with a SPAC have raised cash to fund the deals by issuing convertible bonds, a form of debt that can be swapped into stock. Read More (DealFlow’s SPAC News)

Star-gazing investors launch more money into space tech. Although Jeff Bezos and Richard Branson‘s brief space jaunts have generated massive media interest in space travel, investors have been over the moon about space tech for at least two years now. Venture funding in space travel, satellite communication and aerospace — which includes space-related technologies such as thrusters and propulsion systems — hit a new high last year, and that record is likely to be eclipsed this year. To that point, SPACs have proven very interested in helping birth space tech companies into the public market. Just this month, Google-backed Planet Labs announced it will go public in a $2.8 billion SPAC deal. In April, Seraphim Capital-backed satellite-to-cell company AST & Science — now known as AST SpaceMobile — went public through a SPAC. Also in April, Canadian space operations and satellite company MDA had an initial public offering on the Toronto Stock Exchange. Read More (Crunchbase)

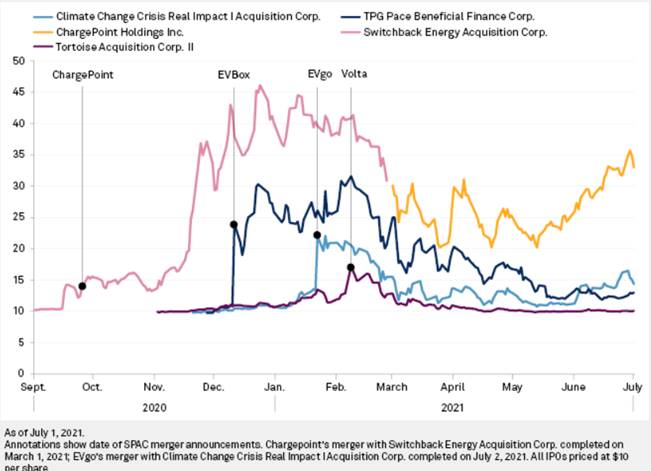

The EV SPAC boom could have been even bigger. Special purpose acquisition companies, or SPACs, are still a hot ticket right now for the electric-vehicle sector. Though many of the companies that went public via this route haven’t fared especially well the last few months, there are still plenty more planned. The latest data from BNEF shows 13 EV-related SPACs that have been completed, and 14 more pending expected acquisitions in the second half of 2021. This includes companies involved not just in making vehicles themselves, but also in the EV battery supply chain and charging infrastructure. The interest in this approach shouldn’t be surprising — most parts of the EV value chain are quite capital-intensive, and it’s a long road between investor slide decks and pilot projects to factories cranking out thousands of vehicles or batteries every week. SPACs have proven a successful way of raising the money needed for these companies to scale up their activities, even before many of them have yet to generate substantial revenues. Read More (Bloomberg)

|

Chart 9: Completed SPAC Deals |

|

|

Source: Intro-act, Bloomberg

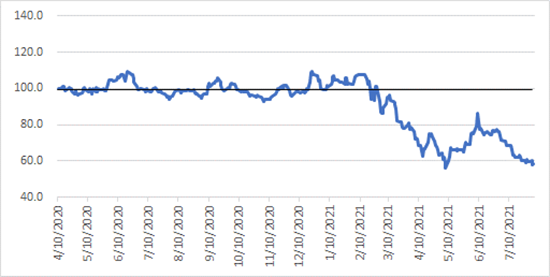

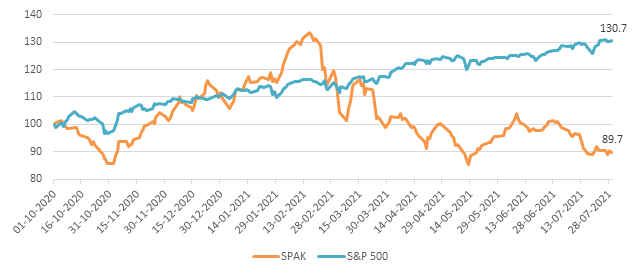

Electric vehicle SPACs try to prove their worth to Wall Street as shares fall. Electric vehicle start-ups that went public through SPAC deals over the past year are trying to prove their worth to Wall Street as investors grow increasingly skeptical of their future. Most deals were initially celebrated by investors, sending shares through the roof but the tides have turned against many of the companies after crackdowns this year by the SEC. The CNBC SPAC Post Deal Index, which is comprised of the largest SPACs that have come to market and announced a target, has fallen by nearly 10% in 2021. Read More (CNBC)

SPAC frenzy to accelerate consolidation wave sweeping EV charging sector. A flurry of upcoming blank-check mergers involving companies targeting the rapidly growing market for electric vehicle charging is set to accelerate a wave of acquisitions sweeping through the sector, according to executives and analysts. Following the listings of ChargePoint Holdings Inc. in February and EVgo Services LLC on July 2, at least three more EV charging companies are planning to go public by merging with a special purpose acquisition company over the coming months. Despite still making heavy losses, they hope to tap into the same investor enthusiasm for the switch to EVs that has buoyed carmakers such as Tesla Inc. The four latest companies to go public via SPACs, which include Volta Industries Inc., EVBox BV and Wallbox Chargers SL, expect to raise roughly $2 billion between them. With their newfound financial firepower, they could start to snap up smaller peers in the increasingly competitive charging space. Read More (S&P Global)

|

Chart 10: Share Prices of EV Charging Companies in SPAC Deals ($) |

|

|

Source: Intro-act, S&P Global

Digital health startups raised $14.7 billion in first half of 2021, already surpassing total 2020 funding. Digital health funding continues to smash new records each quarter, as venture-backed companies raised $14.7 billion in the first half of the year. That sum already surpasses the total venture funding raised in all of 2020, according to a new report from venture firm Rock Health. The Covid-19 pandemic has fueled the adoption of new digital health technologies, which already set an all-time high venture funding record of $6.7 billion in the first quarter of 2021. Rock Health’s CEO Bill Evans says that while even he was a bit surprised by such a huge increase compared to last year, the fundamentals checked out. “We saw pace increase and size per round increase,” says Evans. This translated to an average of 11 digital health deals totaling $548 million each week in the first six months of the year, compared to an average of 7 deals totaling $285 million in the second half of 2020. Read More (Forbes)

Tech and Special Purpose Acquisition Companies (SPACs) see interests align. As SPACs continue their urgent search for appropriate companies to acquire and take public, high growth technology companies are amongst the most sought-after targets. Research suggests that tech businesses are the preferred target for a large number of SPACs that have declared which sectors they are looking to invest in. The research also indicates that the TMT sector accounts for considerably more than other sectors (30% of SPAC investment). And the attraction goes both ways, it seems. Why is this? Read More (JD Supra)

SPACs are great alternative for Tech. Khosla Ventures co-founder Vinod Khosla discusses the continuing popularity of tech companies deciding to go public via SPACs including Berkshire Grey, warehouse automation company and Khosla Ventures investment recipient. He speaks with Emily Chang on “Bloomberg Technology.” Watch Video (Bloomberg)

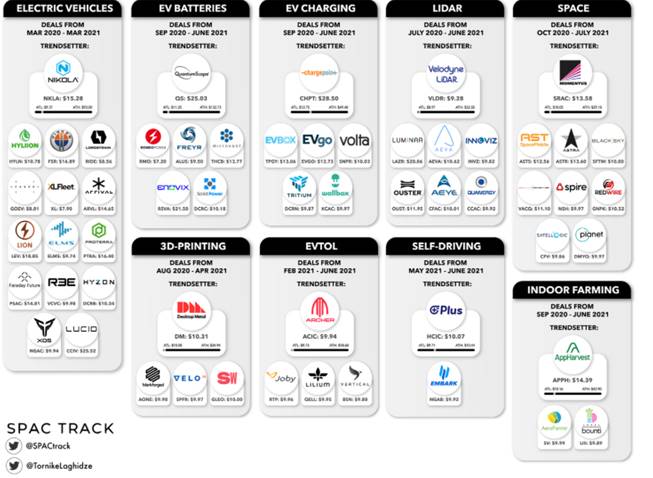

Graphics are tight. After a SPAC merger has been announced with a target in an emerging technology sector, it is common for competitors from that sector to follow suit over the following months. Competitors can be, in effect, forced to go public to prevent the others from gaining the advantage (the capital injection, access to the public market, recognition, and so on). Below is a graphic by SPAC Track contributor, Tornike Laghidze, showing the emerging technology sector runs the SPAC market has experienced. Read More (SPAC Track)

|

Chart 11: Follow the SPAC Leader – Emerging Tech Sector Runs |

|

|

Source: Intro-act, SPAC Track

Sports SPACs may look overseas as proverbial shot clock winds down. According to Pitchbook, the number of SPACs that have merged with non-U.S. companies has risen six quarters running. In Q2 2021, nearly one in five completed SPAC transactions (17 out of 91) was with a foreign business (up from 13% in Q1). That trend has not taken hold within the sports and entertainment sector, though. Just two SPACs formed within the last year combined with an international company: Sports Entertainment Acquisition Corp merged with Super Group and dMY Technology Group II merged with Genius Sports. But conversations with a trio of SPAC sponsors—including Acies Acquisition Corp. and Acies Acquisition II co-CEO Dan Fetters—indicated that could change over the next 12 months. “People will go further afield from their core knitting as the shot clock winds down,” he said. Remember, SPACs typically have two years to consummate a deal before they need to return the money raised to investors. Read More (Yahoo! Sports)

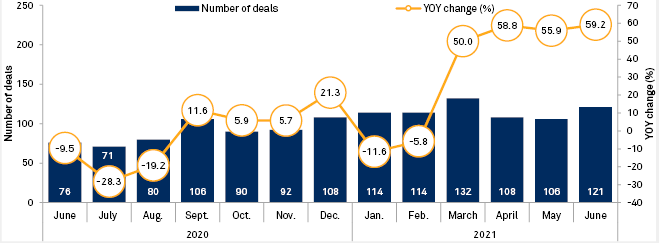

Universal SPAC deal among leaders in June media, telecom M&A. June continued the 2021 recovery in media and telecom M&A, with a headline-making special purpose acquisition company deal accounting for one of the largest transactions announced during the month. Sector deal announcements totalled 121 transactions in June, up from just 76 deals in the prior-year period. That was not only an improvement over 2020's pandemic era total but also over June 2019. June's transactions were led by two big announcements, with Platinum Equity LLC's $6.74 billion acquisition of educational media company McGraw-Hill Education Inc. topping the M&A chart. Read More (S&P Global)

|

Chart 12: North America M&A Activity: Media and Telecommunication Services |

|

|

Source: Intro-act, S&P Global

SPAC fever hits autonomous vehicle sector. Autonomous vehicle (AV) start-ups have raised billions of dollars to develop and test their self-driving technology. They will need far more to continue developing, testing and eventually deploying various AV use-cases. There is more venture capital available, but at some point, most of the AV start-ups will need to become public companies. There are now two routes they can take — traditional IPO or via a SPAC. Below is a summary of AV startups that have gone public using SPACs or intend to. TuSimple is the only AV company that has done a traditional IPO and it is included in the table. Read More (EET Asia)

|

Chart 13: Autonomous Vehicle SPAC and IPO Trends |

|

|

Source: Intro-act, EET Asia, Egil Juliussen, July 2021.

The climate tech SPAC boom is just beginning. The hype surrounding SPACs may be cooling off after a year in which they were the hottest new thing on Wall Street. But the companies—which are designed to merge with or acquire a promising startup that needs quick access to a lot of capital without the expense, time, and regulatory hassle of a traditional initial public offering—are well-suited to tackling the climate change crisis. SPACs are just beginning to heat up for climate tech. Phyllis Newhouse learned that first-hand this month. After a two-decade career working on cybersecurity in the US military, Newhouse decided to take a stab leading a tech company in the private sector. She joined forces with venture capitalist Isabelle Freidheim to launch Athena Technology Acquisition Corp., an all-female-led SPAC that went public in March. Read More (Quartz)

Beware of SPAC listings, EU markets watchdog tells investors. Investing in SPACs may not be appropriate for everyone, and additional action may be needed to preserve investor protection, the European Union’s markets watchdog said, Reuters reports. More than 400 SPACs have been listed globally so far this year, with Wall Street dominating as Europe plays catch up. But the European Securities and Markets Authority (ESMA) said SPACs “may not be appropriate for all investors” due to risks from dilution, conflicts of interests and uncertainty as to the identification and evaluation of the target company. It set out how SPACs should tell investors about risks, business strategy and criteria for selecting a target company, with the extent of dilution, such as from payment of fees in shares, illustrated by using tables or diagrams. Read More (Reuters)

UK to adopt a new SPAC listing regime from 10 August 2021. The UK, acting through the Financial Conduct Authority (FCA), will implement a new SPAC listing regime from 10 August 2021. This follows a consultation launched in April 2021 on the back of recommendations made by Lord Hill in his review of the UK listing regime. The new regime removes the presumed suspension of a SPAC’s shares upon announcement of a de-SPAC until a prospectus on the enlarged group is published, which has been one of the main reasons that most recent SPAC activity in Europe has taken place on one of the Euronext exchanges, principally Amsterdam and Paris, rather than in London. Read More (JD Supra)

Cash-hungry emerging markets arrive late to the SPAC party. Emerging markets have so far been on the fringes of a fundraising boom using so-called SPACs or special-purpose acquisition companies, which could potentially unlock a vital new source of cash for entrepreneurs in developing regions. But the take-off of SPAC fundraisings in these markets’ hinges in part on the success of a few recently delayed landmark deals, reflecting wider global investor caution about this funding tool. But SPACs are expected to feature more prominently in future fundraisings for emerging market entrepreneurs, opening more capital and operational expertise. Read More (KFGO)

Asia M&A bonanza fuelled by Southeast Asia, private equity deals. Asian merger and acquisition activity surged to its second-highest level ever for a first half as Southeast Asian and private-equity deals hit records, and bankers expect the strong momentum to be maintained for the rest of the year. Announced deals involving Asian companies came to $707.7 billion in January-June, up 75% from the same period a year earlier and not far off the record of $758.6 billion logged in the first half of 2018, Refinitiv data showed. Southeast Asia deals jumped 83% to a record $124.8 billion driven by blockbuster transactions including ride-hailing giant Grab's $40 billion merger with U.S. special-purpose acquisition company (SPAC) Altimeter Growth Corp (AGC.O). Read More (Reuters)

Indian companies are mulling SPAC listings, but one size doesn’t necessarily fit all. Despite the buzz, businesses in India should do their homework before using a SPAC structure as the reality is complex, says Tanya Aggarwal, partner at S&R Associates. “A direct outbound merger of an Indian operating company with a SPAC is not feasible under current regulations. While a swap of shares could be explored, the SPAC structure is most suited for Indian businesses that have externalized, i.e., have a foreign holding company,” Aggarwal explains. Indian businesses will also need to be prepared to comply with stringent governance, accounting, and disclosure norms applicable in the U.S., Aggarwal notes. Read More (Asian Legal Business)

SPACs are targeting Southeast Asia’s start-ups, and investors are taking note. More than 40 SPACs — or special purpose acquisition companies — are targeting the region, according to Vinnie Lauria, managing partner at early-stage venture capital firm Golden Gate Ventures. Other late-stage investors, including private equity players, are taking note, and writing large checks in the region, he said. Southeast Asia’s start-ups reportedly raised a record $6 billion in the first three months of the year, including an over $2 billion funding round by logistics and courier service company J&T Express. Last month, Singapore-based start-up Carro, which operates an online marketplace predominantly for pre-owned cars, snagged $360 million in fresh funds. Read More (CNBC)

New listing rules for China's tech companies could 'dampen' appetite for SPAC deals. Heightened oversight of foreign listings by China's tech unicorns and an uncertain regulatory environment could weigh on the pace of deals by special purpose acquisitions companies (SPACs) seeking to acquire Chinese companies as they deploy huge financial war chests raised in the past year, according to deal makers and sponsors. So-called blank-cheque companies raised more than US$105 billion in the first half of this year and sponsors - both based in Asia and in the US - have been increasingly turning their attention to targets in Asia, particularly growth companies in China, as the marketplace has become more saturated. China is home to two-thirds of Asia's tech unicorns. However, a new slate of draft rules announced last week by the Cyberspace Administration of China (CAC) threatens to slow the rate of US listings by Chinese tech companies - and attractiveness of those companies to American investors. Read More (Yahoo! Finance)

The SPAC wave hits Russia. Could a company from Russia, or with strong connections to Russia, ever be targeted by a SPAC? The question remained open until very recently, given the small numbers of international IPOs from Russia — the latest example in the digital field being Ozon in November last year. Such a player has now emerged, with Nexters preparing its NASDAQ introduction through a combination with SPAC company Kismet. Nexters is among the most successful game development companies with Russian founders. It is behind such hit games as Hero Wars and Throne Rush, claiming more than 200 million installs worldwide. It has established its headquarters in Cyprus and split its teams between Limassol, Moscow and other Eastern European locations. Read More (East-West Digital News)

IBC CLOSURES

AvePoint, Inc. (AVPT) and Apex Technology Acquisition Corp. complete business combination. AvePoint, Inc, the largest Microsoft 365 data management solutions provider, has completed its business combination with Apex Technology Acquisition Corporation, a publicly traded SPAC. Apex shareholders approved the transaction at its stockholder's meeting held on June 30, 2021. The combined company started trading on The Nasdaq Capital Market on July 2, 2021 under the ticker symbol "AVPT" for AvePoint common stock and "AVPTW" for AvePoint warrants. AvePoint received approximately $492 million in gross proceeds comprised of Apex's $352 million of cash held in trust following de minimis public stockholder redemptions and $140 million from an ordinary share private investment in public equity (PIPE), excluding transaction fees. Read More (PR Newswire)

Sharecare, Inc. (SHCR) and Falcon Capital Acquisition Corp. complete business combination. Sharecare, Inc., the digital health company that helps people manage all their health in one place, has completed its business combination with Falcon Capital Acquisition Corp. (NASDAQ: FCAC), a special purpose acquisition company. The transaction was approved by Falcon's shareholders on June 29, 2021, during a Special Meeting in which 97% of the votes cast were in favor of merger. Beginning July 2, 2021, Sharecare's shares of Class A common stock started trading on the NASDAQ under the symbol "SHCR." As a result of the business combination, Sharecare will receive gross proceeds of over $571 million, prior to transaction expenses, including investments from funds managed by Koch Strategic Platforms, Baron Capital Group, Eldridge, Woodline Partners LP, and strategic partner, Digital Alpha which will be used to fuel continued growth, engagement, and innovation. Read More (PR Newswire)

EVgo Services, LLC (EVGO) and Climate Change Crisis Real Impact I Acquisition Corp. complete business combination. EVgo Services, LLC, the nation’s largest public fast charging network for electric vehicles (EVs) and first powered by 100% renewable electricity, has completed its business combination with Climate Change Crisis Real Impact I Acquisition Corp. The transaction was unanimously approved by CLII’s Board of Directors and was approved at a special meeting of CLII stockholders on June 29, 2021. Beginning July 2, 2021, EVgo Inc.’s Class A common stock and EVgo Inc.’s warrants started trading on The Nasdaq Global Select Market under the symbols “EVGO” and “EVGOW,” respectively. The transaction is primarily comprised of approximately $230.0 million of cash from CLII’s former trust account and $400.0 million of cash from a private investment in public equity (PIPE), not including redemptions and transaction fees. Read More (EVgo)

Alight Solutions (ALIT) and Foley Trasimene Acquisition Corp. complete business combination. Alight Solutions, a leading cloud-based provider of integrated digital human capital and business solutions, and Foley Trasimene Acquisition Corp. (NYSE: WPF), a special purpose acquisition company, have completed their business combination, which was approved by Foley Trasimene stockholders on June 30, 2021, and closed on July 2, 2021. Alight, Inc.’s Class A common stock and warrants started trading on the New York Stock Exchange on July 6, 2021, under the ticker symbols “ALIT” and “ALITW,” respectively. With more than 25 years of operating history, Alight provides mission-critical solutions across health, wealth, and global payroll — connecting the dots between people, work, and life to help employees stay healthy, gain financial security, and make better decisions in these areas to improve their overall wellbeing. Read More (Business Wire)

FREYR AS (FREY) and Alussa Energy Acquisition Corp. complete business combination. FREYR AS, a Norway-based developer of clean, next-generation battery cell production capacity, and Alussa Energy Acquisition Corp. (NYSE: ALUS), a Cayman Island exempted special purpose acquisition company, has completed their business combination. The business combination was approved at the special meeting of shareholders of Alussa Energy on June 30, 2021. The combined company now operates as FREYR Battery and its common stock and warrants started trading on the New York Stock Exchange under the ticker symbols “FREY” and “FREY WS”, respectively, on July 8, 2021. The business combination provides equity funding for FREYR’s battery cell manufacturing development strategy, including the development of up to 43 GWh of annual battery cell production capacity at Mo i Rana, Norway. Read More (Business Wire)

Sunlight Financial Holdings Inc. (SUNL) and Spartan Acquisition Corp. II complete business combination. Sunlight Financial, a premier, technology-enabled point-of-sale financing company, completed its business combination with Spartan Acquisition Corp. II (NYSE: SPRQ), a publicly traded special purpose acquisition company. The combined company is named Sunlight Financial Holdings Inc. and on July 12, 2021, its common stock began trading on the New York Stock Exchange under the ticker symbol "SUNL". Sunlight Financial is a premier, technology-enabled point-of-sale finance company. Sunlight partners with contractors nationwide to provide homeowners with financing for the installation of residential solar systems and other home improvements. Read More (PR Newswire)

Wheels Up Partners Holdings LLC (UP) and Aspirational Consumer Lifestyle Corp. complete business combination. Aspirational Consumer Lifestyle Corp. (NYSE: ASPL), a special purpose acquisition company, announced that its shareholders have voted to approve the business combination with Wheels Up Partners Holdings LLC, the leading brand in private aviation. The business combination closed on July 13, 2021, after which Wheels Up's Class A common stock and warrants listed on the New York Stock Exchange under the ticker symbols "UP" and "UP WS", respectively, and ASPL was renamed "Wheels Up Experience Inc." Read More (PR Newswire)

Enovix Corporation (ENVX) and Rodgers Silicon Valley Acquisition Corp. complete business combination. Enovix Corporation, the leader in the design and manufacture of 3D Silicon™ Lithium-ion batteries, has completed its business combination with Rodgers Silicon Valley Acquisition Corp. (Nasdaq: RSVA, RSVAU, RSVAW), a publicly traded special purpose acquisition company or SPAC. RSVAC’s shareholders approved the combination at a special meeting held on July 12, 2021. The combined company will retain the name Enovix Corporation and started trading on the Nasdaq Global Select Market on July 15, under the new ticker symbol “ENVX” for Enovix common stock and “ENVXW” for Enovix warrants. Read More (GlobeNewswire)

The Hillman Group, Inc. (HLMN) and Landcadia Holdings III, Inc. complete business combination. HMAN Group Holdings Inc., the parent company of The Hillman Group, Inc., a leader in the hardware and home improvement industry, and Landcadia Holdings III, Inc. (Nasdaq: LCY) have completed their business combination. The business combination was approved at a special meeting of Landcadia III stockholders on July 13, 2021, and the combined company changed its name to Hillman Solutions Corp. on July 14, 2021. Beginning on July 15, 2021, Hillman’s common stock and warrants started trading on Nasdaq under the ticker symbols “HLMN” and “HLMNW,” respectively. Founded in 1964 and headquartered in Cincinnati, Ohio, Hillman is a leading North American provider of complete hardware solutions, delivered with industry best customer service to over 40,000 locations. Read More (GlobeNewswire)

Markforged, Inc. (MKFG) and one complete business combination. Markforged, Inc., creator of the integrated metal and carbon fiber additive manufacturing platform, The Digital Forge, has completed merger with one (NYSE: AONE), a special purpose acquisition company sponsored by A-star and founded and led by technology industry veteran Kevin Hartz. The combined company, named Markforged Holding Corporation, started trading on the New York Stock Exchange on July 15, 2021, under the ticker symbol “MKFG” for Markforged common stock and “MKFG.WS” for Markforged warrants. In connection with the closing of the merger, Markforged has received approximately $361 million of gross proceeds before transaction expenses, including a $210 million PIPE from Baron Capital Group, funds and accounts managed by BlackRock, Miller Value Partners, Wasatch Global Investors, and Wellington Management, as well as existing Markforged shareholders M12 – Microsoft’s Venture Fund and Porsche Automobil Holding SE. Read More (Business Wire)

Owlet, Inc. (OWLT) and Sandbridge Acquisition Corp. complete business combination. Owlet, Inc., a company building a connected and accessible nursery ecosystem that brings technology and vital data to modern parenting, has completed its business combination with Sandbridge Acquisition Corporation. (NYSE: SBG), a special purpose acquisition company. The business combination and concurrent private placement, which were approved by Sandbridge’s stockholders at its special meeting held on July 14, 2021, provide over $135 million to accelerate the OWLT’s expansive product pipeline, deepen penetration, and expand globally. Following the transaction, the company was renamed Owlet, Inc., and its Class A common stock and warrants started trading on the New York Stock Exchange under the symbols “OWLT” and “OWLT WS,” respectively, on July 16, 2021. Read More (Business Wire)

Celularity Inc. (CELU) and GX Acquisition Corp. complete business combination. Celularity Inc. (Nasdaq: CELU), a clinical-stage cellular medicine company developing off-the-shelf allogeneic therapies derived from the postpartum human placenta, has closed its merger with GX Acquisition Corp. and provided a corporate update. Proceeds from the transaction totaled approximately $138 million, which included funds held in GXGX’s trust account and a concurrent private placement investment in public equity (PIPE) financing led by existing Celularity shareholders. GXGX shareholders approved the transaction on July 14, 2021. The combined, publicly traded company will operate under the name Celularity, Inc., and its common stock started trading on the Nasdaq Capital Market on July 19, 2021, under the ticker symbol “CELU.” Read More (GlobeNewswire)

Hyzon Motors Inc. (HYZN) and Decarbonization Plus Acquisition Corp. complete business combination. Hyzon Motors Inc., a leading global supplier of zero-emission hydrogen fuel cell-powered heavy vehicles, has completed its business combination with Decarbonization Plus Acquisition Corp. Concurrent with the completion of the business combination, Decarbonization Plus Acquisition Corporation has changed its name to "Hyzon Motors Inc. Commencing on July 19, 2021, Hyzon's Class A common stock and Hyzon's warrants started trading on The Nasdaq Global Select market under the symbols "HYZN" and "HYZNW," respectively. The transaction was unanimously approved by DCRB's Board of Directors and was approved at a special meeting of DCRB's stockholders on July 15, 2021. Read More (PR Newswire)

Holley Inc. (HLLY) and Empower Ltd. complete business combination. Holley Inc., the largest and fastest growing platform in the enthusiast branded performance automotive aftermarket category, has completed its business combination with Empower Ltd., a publicly traded special purpose acquisition company formed by MidOcean Partners. The business combination was approved by Empower’s stockholders on July 14, 2021. Beginning July 19, 2021, Holley’s shares started trading on the New York Stock Exchange under the ticker symbol “HLLY.” Holley’s President and Chief Executive Officer, Tom Tomlinson, and the current management team will continue to lead the Company. Matthew Rubel, Chief Executive Officer and Executive Chairman of the Board of Directors of Empower, will serve as Chairman of the Board of Directors at Holley. Read More (Business Wire)

Evolv Technologies, Inc. (EVLV) and NewHold Investment Corp. complete business combination. NewHold Investment Corp. (NASDAQ: NHIC), a publicly traded special purpose acquisition company, and Evolv Technologies, Inc., the global leader in weapons detection security screening, have completed their business combination. The transaction has been unanimously approved by the board of directors of NewHold and was approved at a special meeting of NewHold shareholders on July 15, 2021. The common stock of the combined company started trading on the NASDAQ Stock Market under the symbol “EVLV”, its warrants will trade under “EVLVW”, and its units will trade under “EVLVU” beginning July 19, 2021. Peter George, who has served as Chief Executive Officer of the Company since January 2020, will continue to lead the business. Read More (Business Wire)

Stryve Foods, LLC (SNAX) and Andina Acquisition Corp. III complete business combination. Andina Acquisition Corp. III (NASDAQ: ANDA, ANDAW, and ANDAU), a publicly traded special purpose acquisition company, has completed its business combination with Stryve Foods, LLC, an emerging healthy snacking platform disrupting traditional snacking categories and a leader in the air-dried meat snack industry in the U.S. The business combination was approved by Andina’s shareholders at a Special Meeting held on July 19, 2021. The Class A common stock and warrants of Stryve started trading on NASDAQ under the new symbols “SNAX” and “SNAXW,” respectively on July 21, 2021. The business combination included a concurrent private placement of $53.4 million, including subscriptions for $42.5 million of Class A common stock, payable in cash, and subscriptions for $10.9 million of Class A common stock, to be satisfied by the offset of principal and accrued interest under outstanding bridge notes issued by Stryve, as part of the Business Combination. Read More (GlobeNewswire)

Opportunity Financial, LLC (OPFI) and FG New America Acquisition Corp. complete business combination. Opportunity Financial, LLC, a leading financial technology platform that powers banks to help everyday consumers gain access to credit, and FG New America Acquisition Corp. (NYSE: FGNA), a special purpose acquisition corporation, have completed their business combination. The business combination was approved by FGNA’s stockholders at its special meeting held on July 16, 2021, and closed on July 20, 2021. The company now operates as OppFi, Inc. OppFi’s Class A common stock and warrants started trading on the NYSE under the ticker symbols “OPFI” and “OPFI WS,” respectively, on July 21, 2021. OppFi (NYSE: OPFI) is a leading financial technology platform that powers banks to offer accessible products and a top-rated experience to everyday consumers. OppFi helps consumers who are turned away by traditional providers build a better financial path. Read More (Business Wire)

MarketWise, LLC (MKTW) and Ascendant Digital Acquisition Corp. complete business combination. Ascendant Digital Acquisition Corp. (NYSE: ACND) announced that Ascendant’s shareholders have approved all proposals related to its previously announced business combination with MarketWise, LLC, a leading multi-brand digital subscription services platform that provides premium financial research, software, education, and tools for self-directed investors. The combined company is renamed MarketWise, Inc., and its common stock and warrants started trading on The Nasdaq Stock Market under the ticker symbols “MKTW” and “MKTWW”, respectively, on July 22, 2021. Read More (GlobeNewswire)

Berkshire Grey, Inc. (BGRY) and Revolution Acceleration Acquisition Corp. complete business combination. Berkshire Grey, Inc., the leading pure-play robotics company offering fully integrated, AI-based software and hardware solutions to automate warehouses and logistics fulfillment centers, and Revolution Acceleration Acquisition Corp (Nasdaq: RAAC), a special purpose acquisition company, have completed their business combination. Berkshire Grey’s Class A common stock and public warrants started trading on The Nasdaq Stock Market LLC under the ticker symbols “BGRY” and “BGRYW,” respectively, on July 22, 2021. Berkshire Grey helps customers radically change the essential way they do business by delivering game-changing technology that combines AI and robotics to automate fulfillment, supply chain and logistics operations. Read More (Business Wire)

Faraday Future (FFIE) and Property Solutions Acquisition Corp. complete business combination. Faraday Future, a California-based global shared intelligent mobility ecosystem company, has completed its merger with Property Solutions Acquisition Corp., a special purpose acquisition company. The transaction, which was approved by PSAC’s stockholders in a special meeting held on July 20, 2021, resulted in the combined company being renamed Faraday Future Intelligent Electric Inc., with its common stock and warrants started trading on the Nasdaq Stock Market on July 22, 2021, under the ticker symbols “FFIE” and “FFIEW”, respectively. Established in May 2014, Faraday Future is a global shared intelligent mobility ecosystem company, headquartered in Los Angeles, California. Read More (Business Wire)

Matterport, Inc. (MTTR) and Gores Holdings VI complete business combination. Matterport, Inc., the leading spatial data company driving the digital transformation of the built world, and Gores Holdings VI (NASDAQ: GHVI, GHVIU, and GHVIW), a special purpose acquisition company sponsored by an affiliate of The Gores Group, LLC, have completed their previously announced business combination. The combined company is named Matterport, Inc. and started trading on Nasdaq under the new ticker symbol "MTTR" on July 23, 2021. The business combination was approved at a special meeting of Gores Holdings VI stockholders on July 20, 2021. As a result of the business combination, Matterport has received approximately $605 million total cash, net of fees and expenses paid in connection with the closing of the business combination. Read More (PR Newswire)

Sema4 (SMFR) and CM Life Sciences complete business combination. Sema4, a patient-centered health intelligence company leveraging AI and machine learning to derive data-driven insights, has completed its business combination with CM Life Sciences (NASDAQ: CMLF), a special purpose acquisition company sponsored by affiliates of Casdin Capital, LLC and Corvex Management LP. The resulting combined company, Sema4 Holdings Corp, started trading of its shares of common stock and warrants on the Nasdaq Global Select Market under the ticker symbols "SMFR" and “SMFRW” on July 23, 2021. The merger was approved by the stockholders of CM Life Sciences on July 21, 2021. Sema4 is a patient-centered health intelligence company dedicated to advancing healthcare through data-driven insights. Read More (GlobeNewswire)

REE Automotive Ltd. (REE) and 10X Capital Venture Acquisition Corp. complete business combination. REE Automotive Ltd., a leader in e-Mobility, has completed its merger with 10X Capital Venture Acquisition Corp. The business combination was approved at a special meeting of 10X’s stockholders on July 21, 2021. Following the merger, the combined company is named REE Automotive Ltd. Beginning on July 23, 2021, REE’s Class A ordinary shares and warrants started trading on Nasdaq under the ticker symbols “REE” and “REEAW”, respectively. REE is an automotive technology leader creating the cornerstone for tomorrow's zero-emission vehicles. Read More (Business Wire)

Lucid Group, Inc. (LCID) and Churchill Capital Corp. IV complete business combination. Churchill Capital Corp. IV (NYSE: CCIV), a publicly traded special purpose acquisition company, and Lucid Motors have completed their business combination, taking public a company that is setting new standards with its advanced luxury EVs. Shares of common stock and warrants of the post-combination company, renamed Lucid Group, Inc. listed on The Nasdaq Stock Market LLC beginning on July 26, 2021, under the ticker symbols "LCID" and "LCIDW," respectively. Lucid's mission is to inspire the adoption of sustainable energy by creating the most captivating electric vehicles, centered around the human experience. The company's first car, Lucid Air, is a state-of-the-art luxury sedan with a California-inspired design underpinned by race-proven technology. Read More (Lucid)

Microvast, Inc. (MVST) and Tuscan Holdings Corp. complete business combination. Microvast, Inc., a leading global provider of next-generation battery technologies for commercial and specialty vehicles, has completed business combination with Tuscan Holdings Corp. (Nasdaq: THCB). The business combination was approved at a special meeting of stockholders on July 21, 2021, resulting in the combined company being renamed “Microvast Holdings, Inc.”, with its common stock and warrants started trading on the Nasdaq on July 26, 2021, under the ticker symbols “MVST” and “MVSTW”. Upon closing, the combined company received approximately $822 million in cash, comprised of approximately $282 million in cash held in trust by Tuscan and the proceeds of a $540 million PIPE from leading institutional investors. Read More (Business Wire)

Doma Holdings, Inc. (DOMA) and Capitol Investment Corp. V complete business combination. Doma Holdings, Inc., a leading force for disruptive change in the real estate industry, and Capitol Investment Corp. V (NYSE: CAP), a publicly traded special purpose acquisition company, have completed their business combination. Doma is using machine intelligence and its proprietary technology solutions to create a more simple, efficient, and affordable real estate closing experience for current and prospective homeowners, lenders, title agents, and real estate professionals. The shares of common stock and warrants of the combined company started trading on the New York Stock Exchange on July 29, 2021, under the symbols DOMA and DOMA.WS, respectively. Read More (Business Wire)

Reservoir Media, Inc. (RSVR) and Roth CH Acquisition II Co. complete business combination. Reservoir Media, Inc. (NASDAQ: RSVR), an award-winning independent music company, closed its business combination with Roth CH Acquisition II Co., a publicly traded special purpose acquisition company formed by Roth Capital Partners and Craig-Hallum Capital Group. The business combination was approved by ROCC’s stockholders at a special meeting of stockholders held on July 27, 2021. The combined company is named “Reservoir Media, Inc.” Beginning on July 29, 2021, Reservoir’s common stock and warrants started trading on the Nasdaq Capital Market LLC under the ticker symbol “RSVR” and “RSVRW,” respectively. Read More (GlobeNewswire)

Cyxtera Technologies, Inc. (CYXT) and Starboard Value Acquisition Corp. complete business combination. Cyxtera Technologies, Inc., a global leader in data center colocation and interconnection services, has completed its business combination with Starboard Value Acquisition Corp. (NASDAQ: SVAC). The business combination, which was approved by SVAC’s stockholders at its special meeting held on July 28, 2021, provides Cyxtera access to new capital sources to fuel growth, accelerate product and technology innovation, enhance its ability to quickly meet customer needs and support further strategic go-to-market efforts. On July 30, Cyxtera’s shares of Class A common stock started trading on Nasdaq Global Select Market under the symbol “CYXT” and its warrants under the symbol “CYXTW.” Read More (Business Wire)

Rover, Inc. (ROVR) and Nebula Caravel Acquisition Corp. complete business combination. A Place for Rover, Inc., the world’s largest network of five-star pet sitters and dog walkers, and Nebula Caravel Acquisition Corp. (NASDAQ: NEBC), a special purpose acquisition company sponsored by True Wind Capital Management, L.P., have closed their business combination agreement. The business combination was approved by Caravel’s stockholders at a meeting held on July 28, 2021. Upon completion of the business combination, Caravel changed its name to Rover Group, Inc., and its common stock and warrants started trading on the Nasdaq Stock Exchange under the ticker symbols “ROVR” and “ROVRW”, respectively, on August 2, 2021. Read More (Rover)

MERGER TERMINATION

Ackman’s Pershing Square SPAC cancels $4 billion Universal Music deal over SEC scrutiny. Pershing Square Tontine Holdings, a SPAC run by billionaire investor Bill Ackman, said it would not proceed with the $4 billion deal to acquire a 10 percent stake in Vivendi’s Universal Music Group. Ackman said the decision was based on concerns raised by the SEC over whether Pershing’s post-deal IBC structure would qualify under NYSE rules. The SPAC’s legal counsel tried unsuccessfully to dissuade the SEC from its position, he added. The decision to quit the deal was reportedly made by the SPAC’s board. Ackman’s new plan is to buy the Universal Music stake directly with his hedge fund. “In light of our recent experience, our next business combination will be structured as a conventional SPAC merger,” Ackman said in the letter, noting that it has an additional 18 months to complete a new deal. Read More (DealFlow’s SPAC News)